Stop IRS Garnishment Phoenix AZ

A 2016 success to Stop IRS Garnishment Phoenix AZ

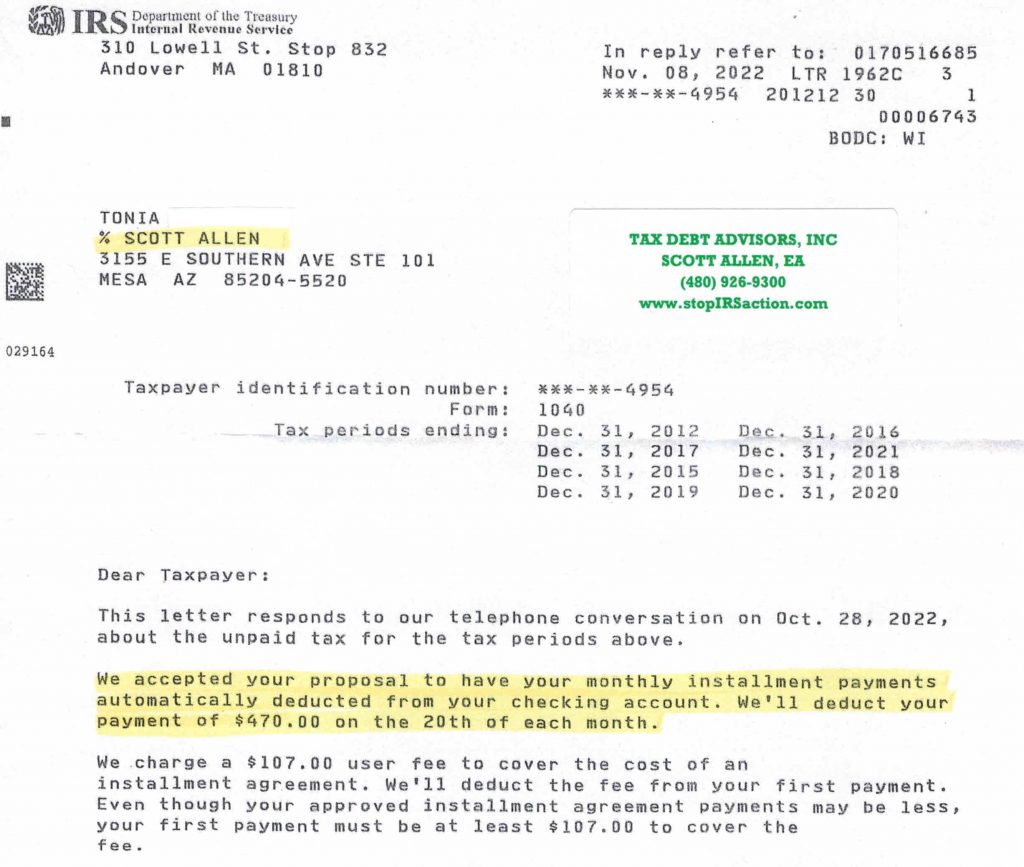

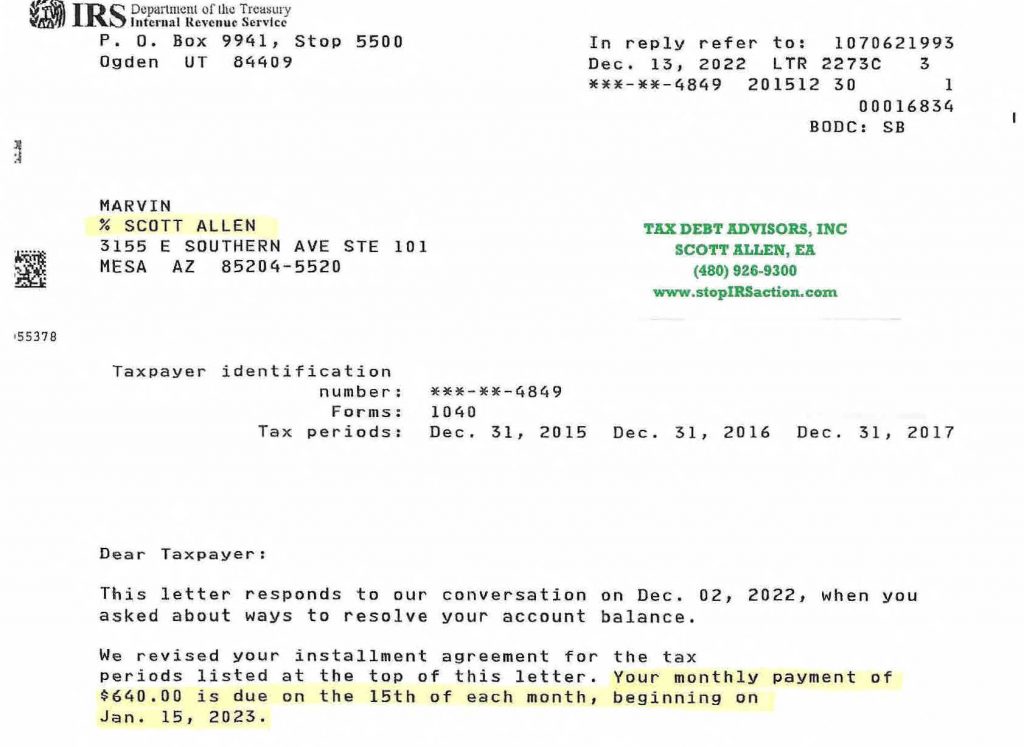

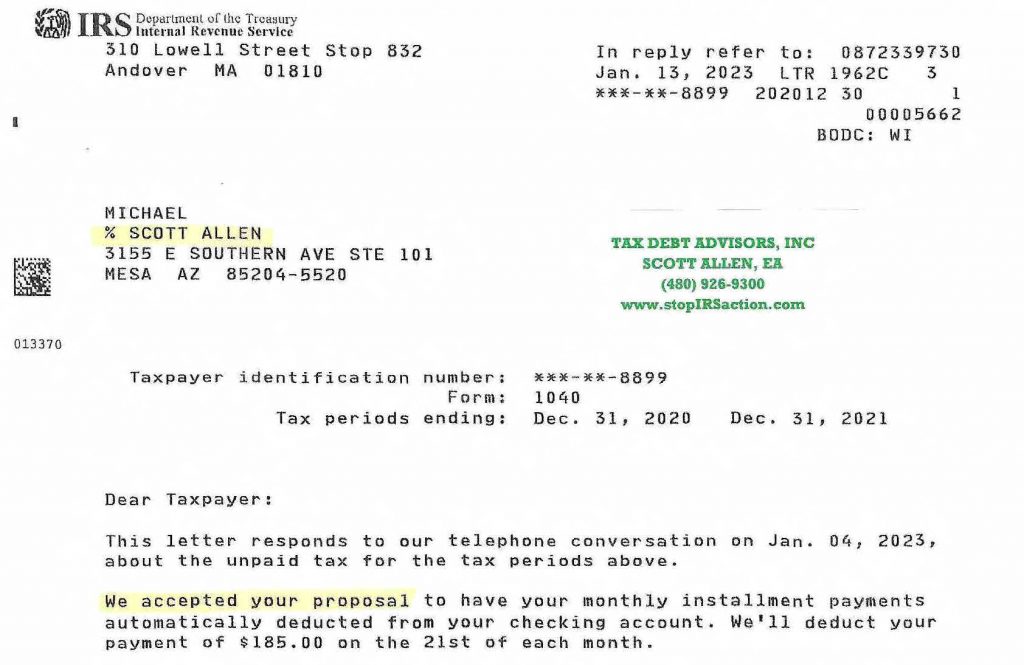

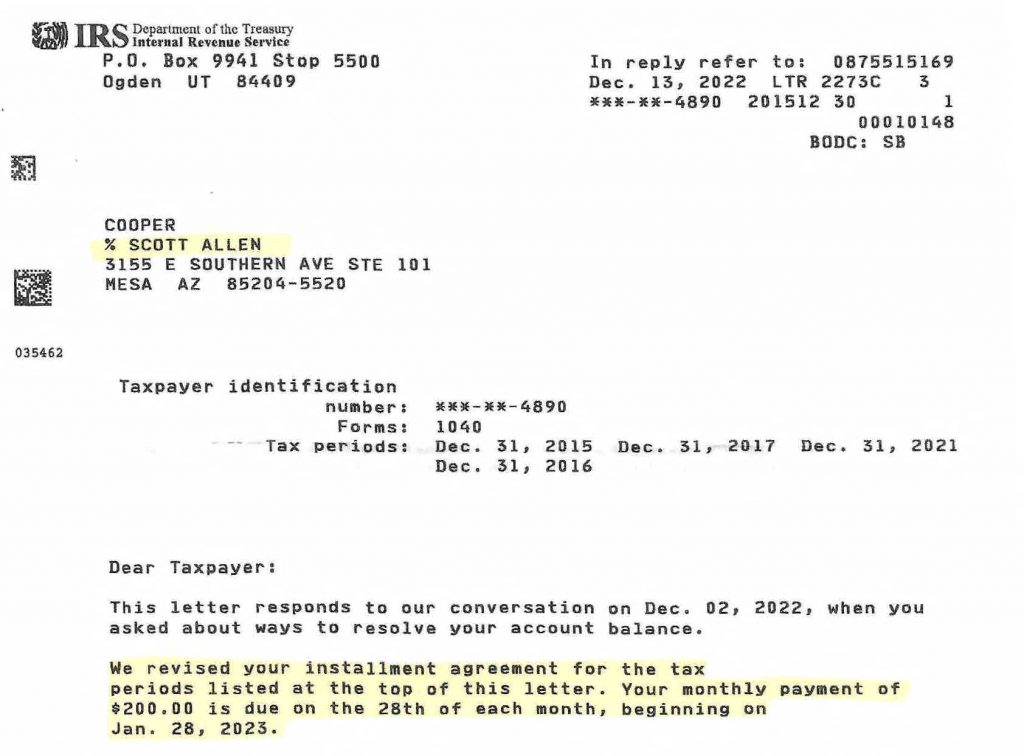

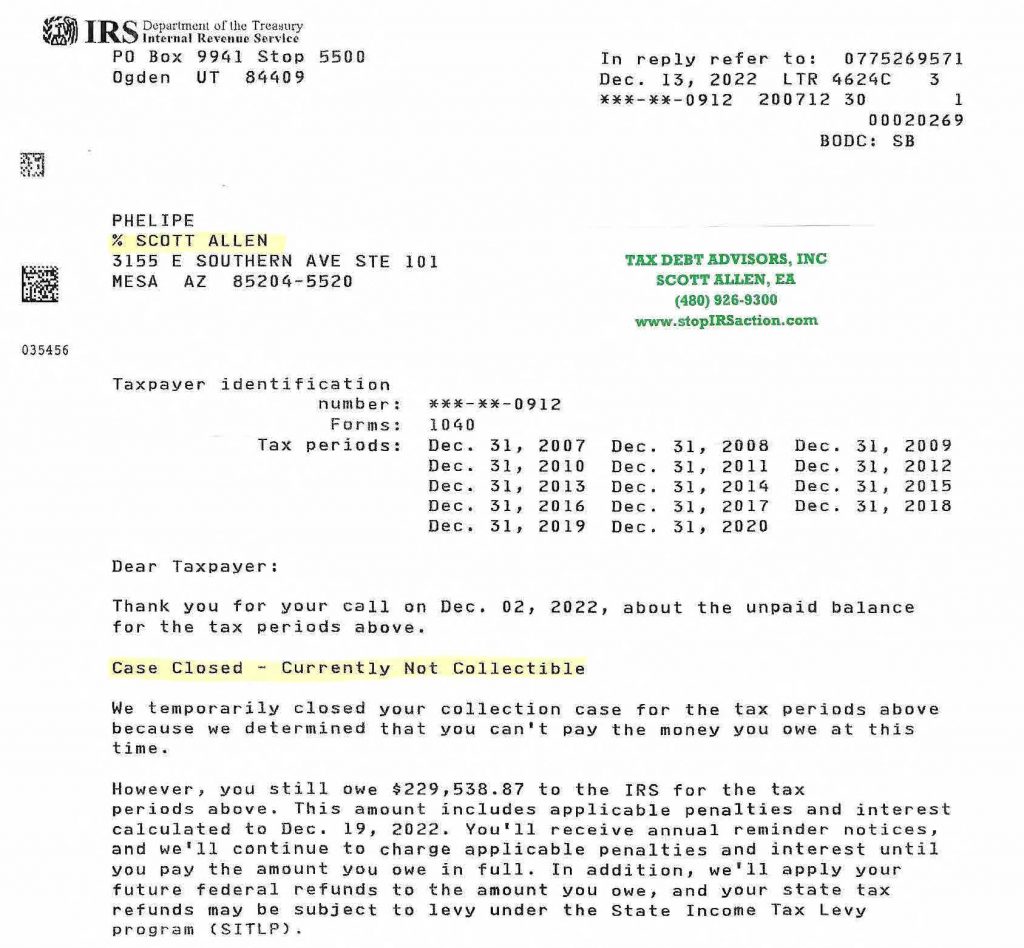

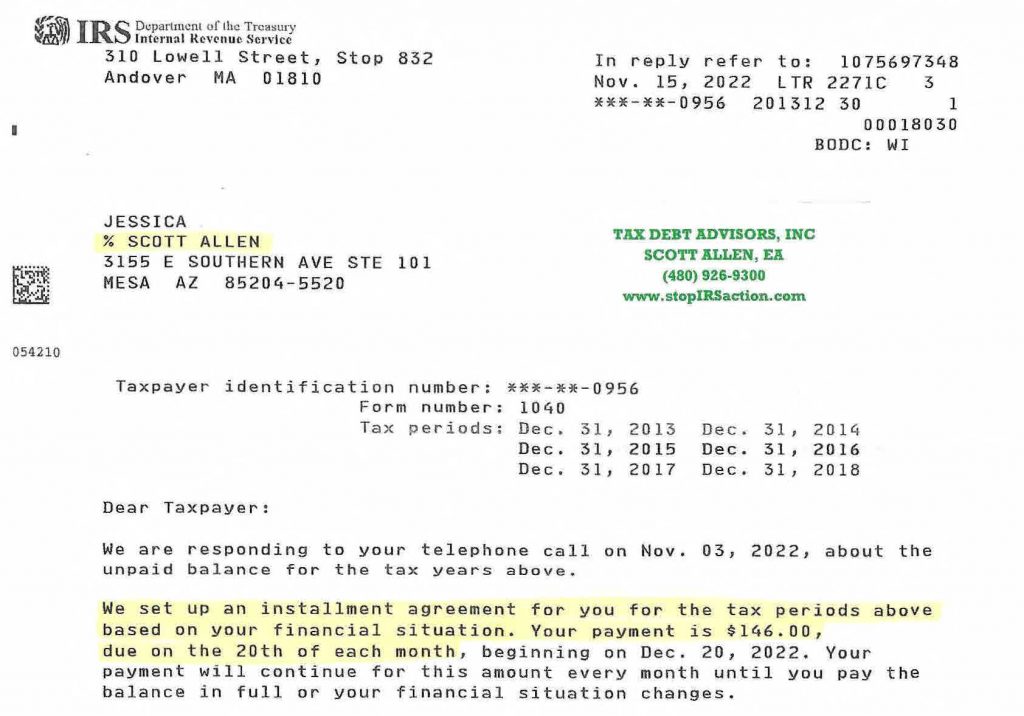

Tax Debt Advisors is a family owned company in Arizona. One of their areas of specialty is to stop IRS garnishment Phoenix AZ. Even better is when they can prevent it from ever happening. If you have received any threatening letters from the IRS it is important to talk with a local tax professional about your situation. Scott Allen EA of Tax Debt Advisors will meet with you for a no obligation consultation to discuss your matter and what the steps are needed to get it resolved. Click here if you are interested in reading more about the process. When situated with a critical tax matter it is important to find the right representation. You will be faced with multiple directions to go. First rule of thumb: work locally! Tax Debt Advisors has a long track record of performing consistently right here in the Phoenix area. Below is a recent success with a client this year. This client was facing an IRS wage garnishment and had several years of back taxes to file as well. Tax Debt Advisors stopped the wage garnishment, prepared and filed the missing tax returns, and settled the total debt into a nice affordable payment plan.

Contact Tax Debt Advisors today to begin the process for yourself. You will be advised of all available options to you.

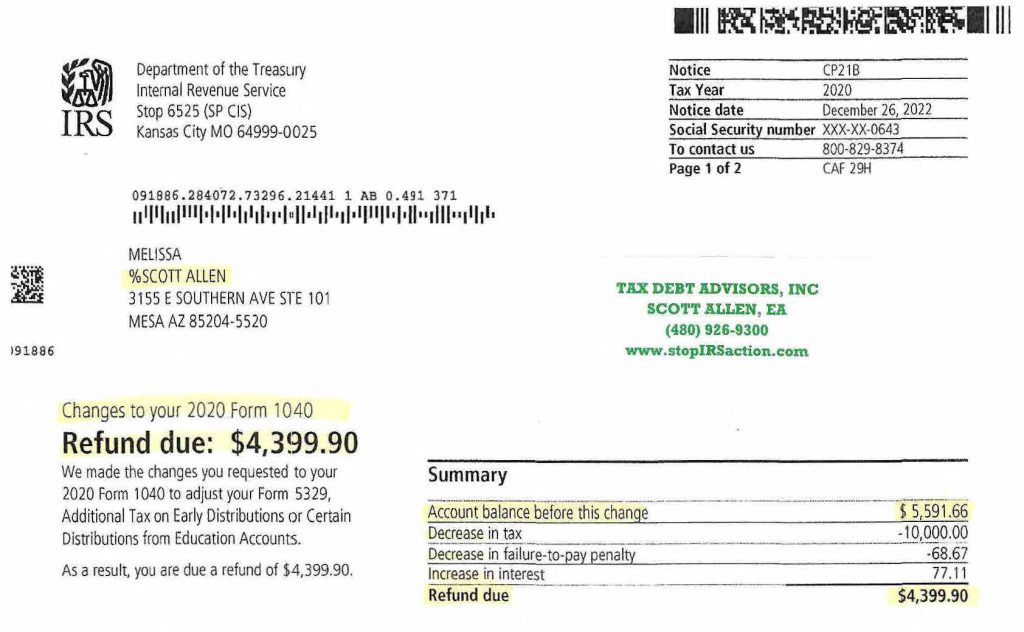

A 2023 success to Stop IRS Garnishment Phoenix AZ

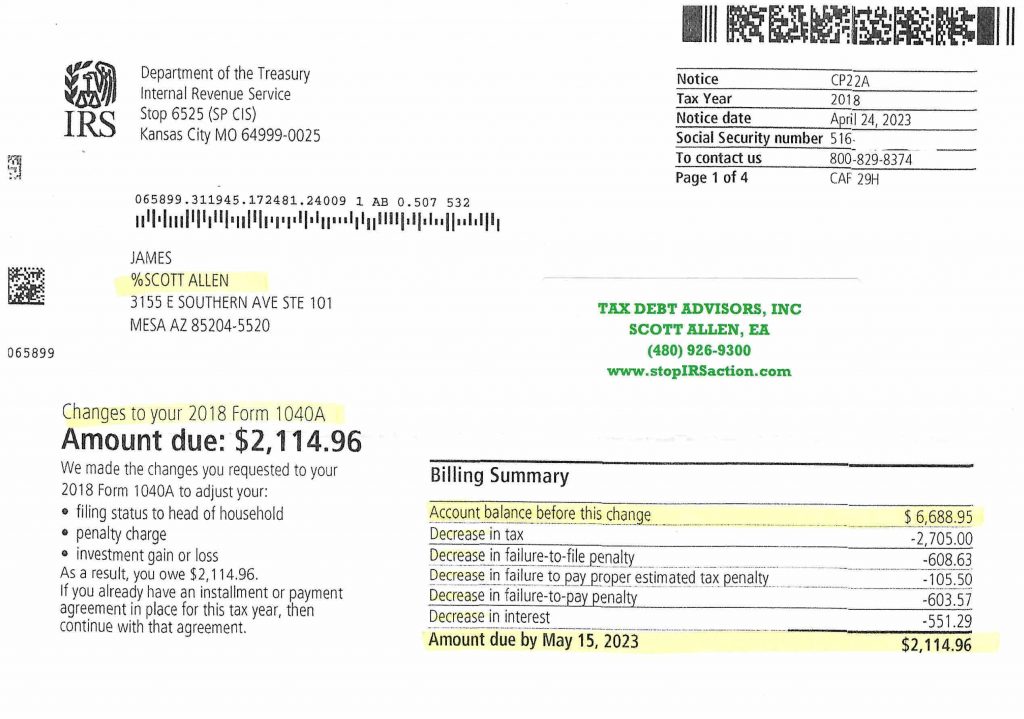

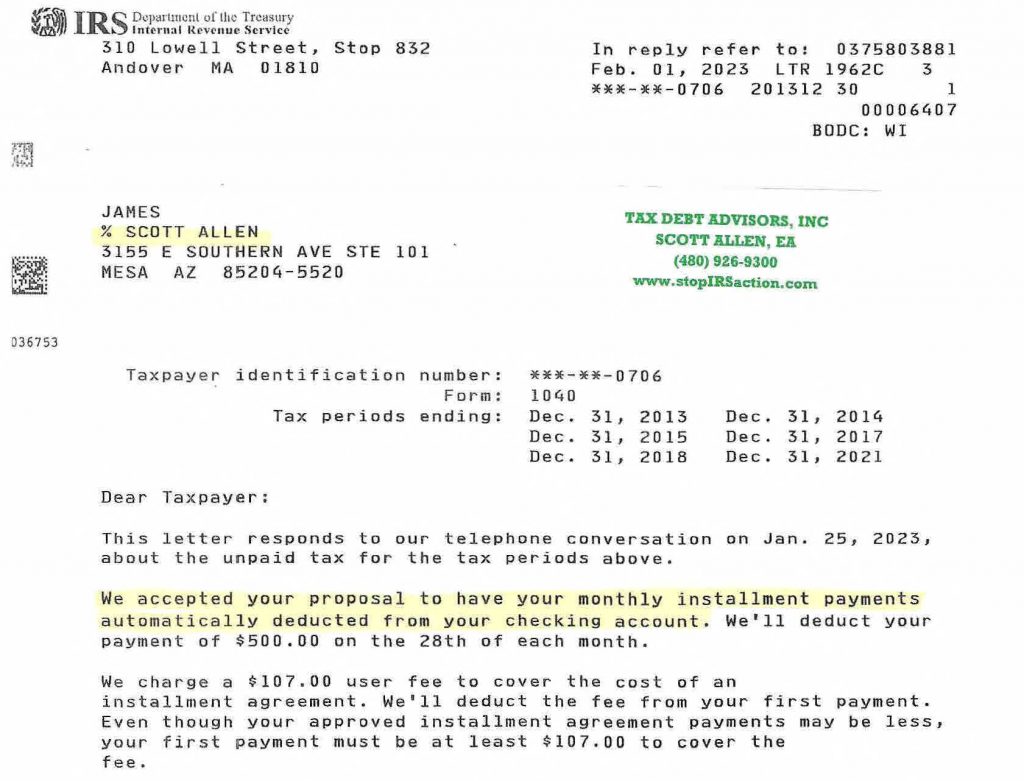

Sometimes the best way to stop IRS garnishment Phoenix AZ is to reduce your tax bill enough so you can set up a simple payment plan or just pay off the debt. James owed the IRS for over $6,600 on a 2018 tax year. He couldn’t just pay them off in full and the IRS was threatening to garnish his wages. After meeting with Scott Allen EA it was determined that they could file a protest to the SFR tax return the IRS filed against him and knock off most the tax debt owed. As you can see from the notice below Scott Allen EA was about to get the IRS to remove $4,500 of the tax bills just by giving the taxpayer his proper filing status, deductions and dependents.

If you need to stop IRS garnishment Phoenix AZ consider giving Scott Allen EA a call today to discuss your specific tax matter.