Tax Debt Advisors, Inc.: Your Phoenix AZ IRS Tax Relief Specialists

Tax Debt Advisors, Inc. for Phoenix AZ IRS Tax Relief

If you’re struggling with IRS debt, you’re not alone. Millions of Americans owe money to the IRS, and the stress of dealing with this debt can be overwhelming. But there is help available. Tax Debt Advisors, Inc. is a Phoenix AZ IRS tax relief company that has been helping taxpayers get out of debt for over 45 years.

What is Tax Debt Advisors, Inc.?

Tax Debt Advisors, Inc. is a family-owned and operated company that specializes in helping taxpayers resolve their IRS debt. Scott Allen EA is a licensed tax professional who can help you understand your options and develop a personalized plan to get you out of debt.

What services do we offer?

We offer a variety of IRS tax relief services, including:

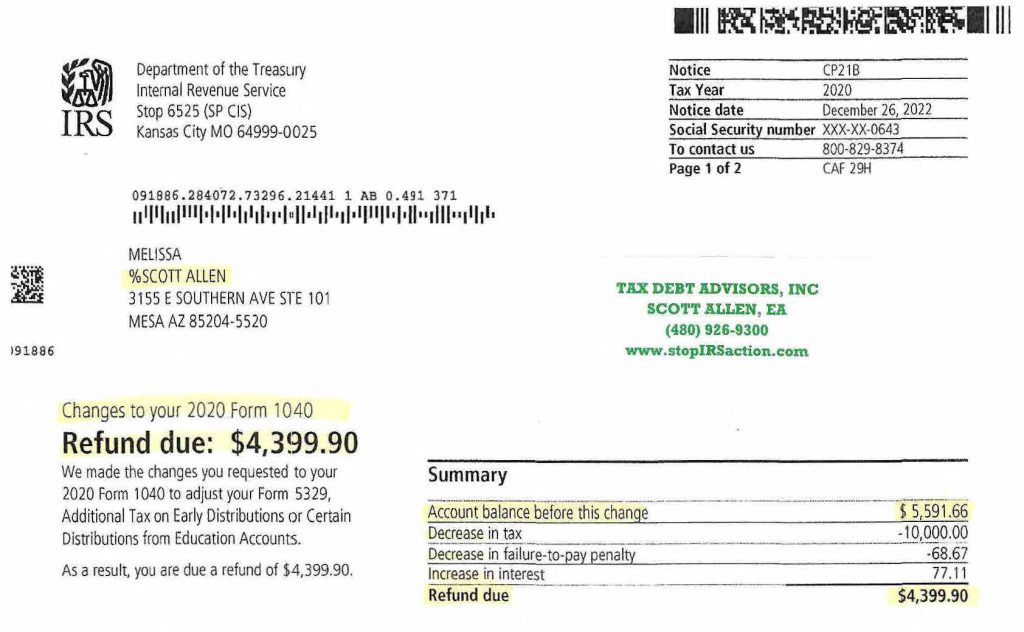

- Tax debt settlement: We can negotiate with the IRS on your behalf to reach a settlement that you can afford.

- Offer in Compromise: We can help you qualify for an Offer in Compromise, which is a way to settle your tax debt for less than the full amount owed.

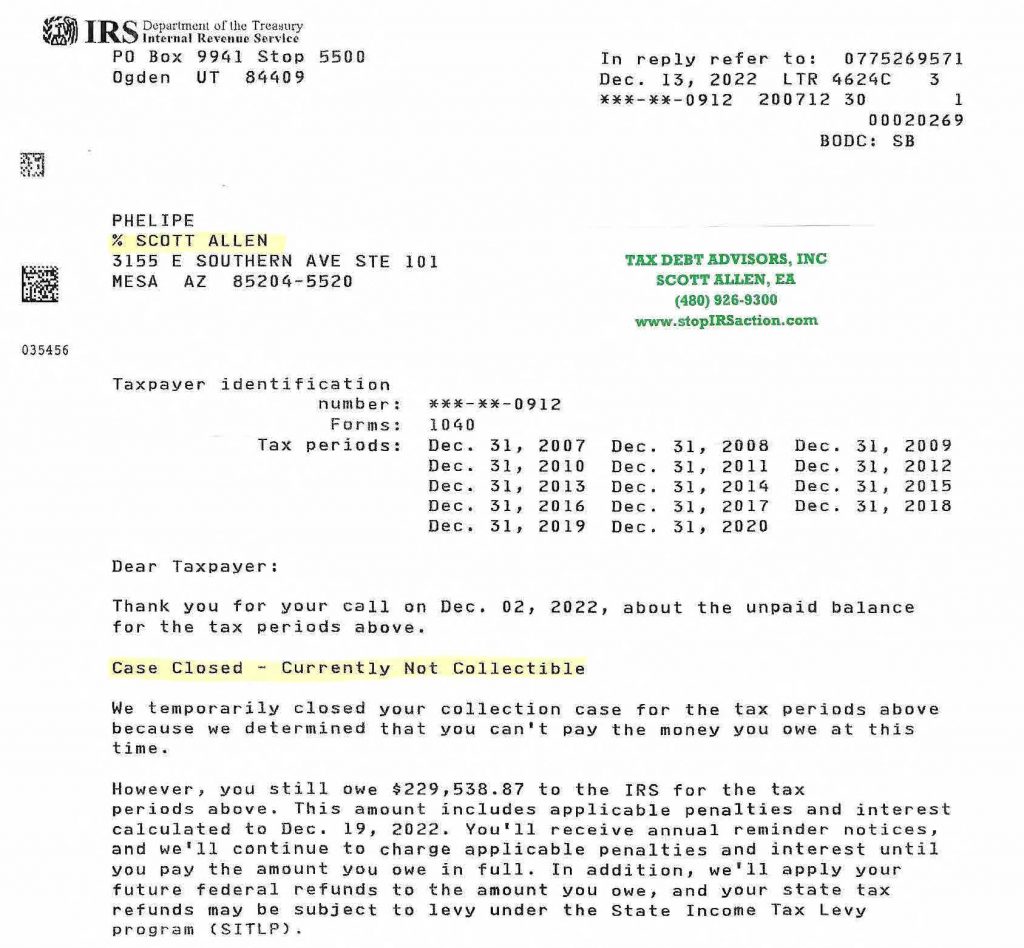

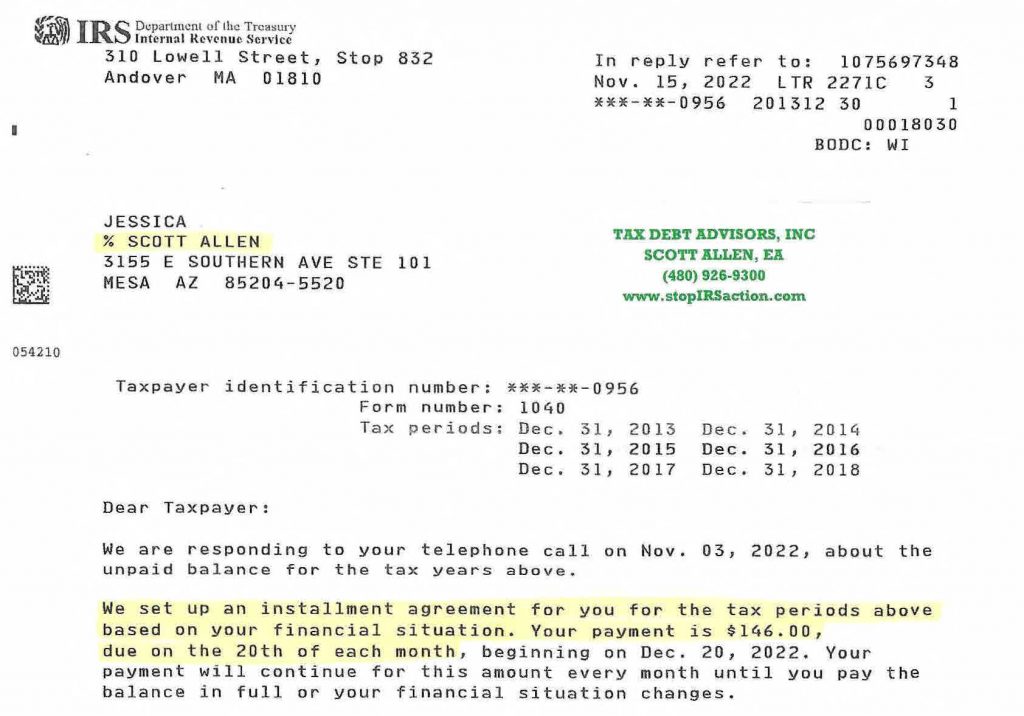

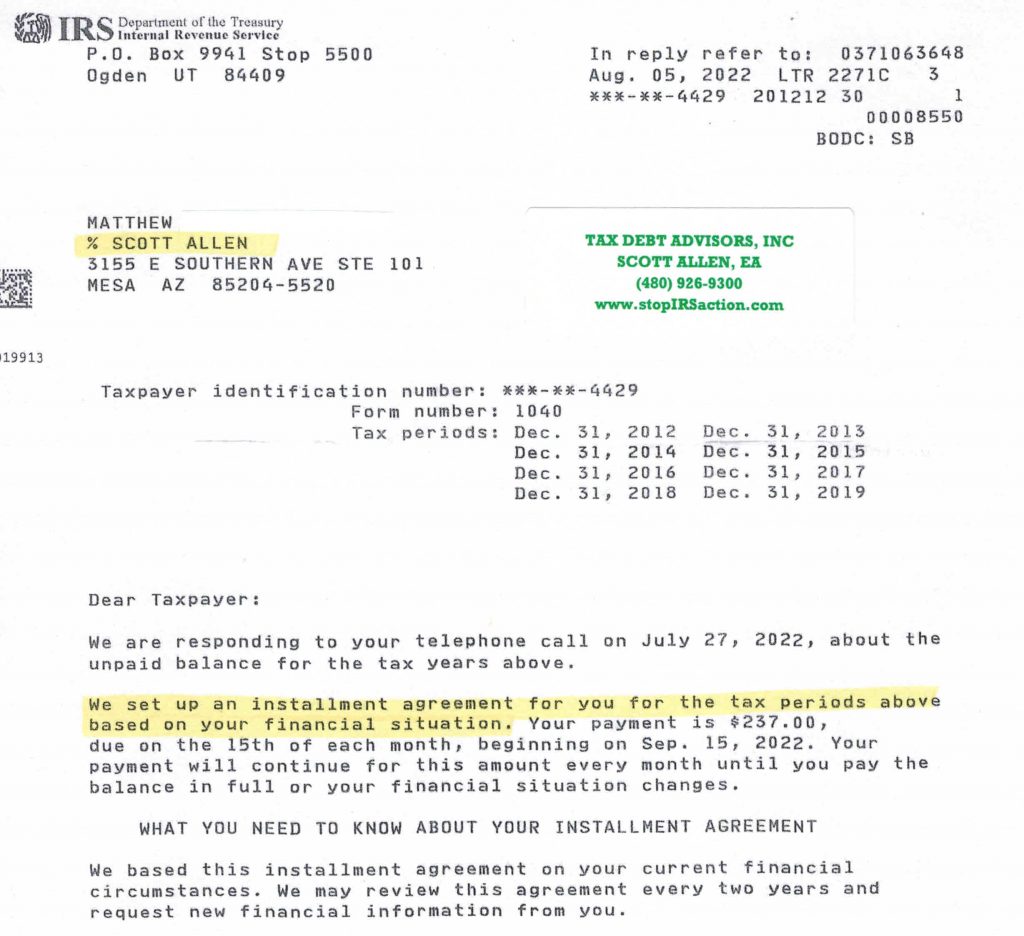

- Installment Agreement: We can help you set up an installment agreement with the IRS so that you can pay your debt off over time.

- Penalty Abatement: We can help you get penalties waived on your tax debt.

- Audit Representation: We can represent you in an IRS audit to help protect your rights.

Why choose Tax Debt Advisors, Inc.?

There are many reasons to choose Tax Debt Advisors, Inc. as your Phoenix AZ IRS tax relief company. Here are just a few:

- We’re experienced: We’ve been helping taxpayers resolve their IRS debt for over 45 years. We have the knowledge and expertise to get the job done right.

- We’re affordable: The fees we charge are always offered at a competitive rate if not less expensve then most Phoenix AZ IRS tax relief companies.

- We’re trustworthy: We’re a family-owned and operated company with a reputation for honesty and integrity.

How do we get started?

To get started, simply contact us for a free consultation. We’ll review your situation and discuss your options. If you decide to work with us, we’ll get started right away on developing a specific plan to get the IRS off your back.

If you’re struggling with IRS debt, don’t wait any longer. Contact Tax Debt Advisors, Inc. today for a free consultation. We’ll help you get the Phoenix AZ IRS tax refilef you deserve and start living your life again.

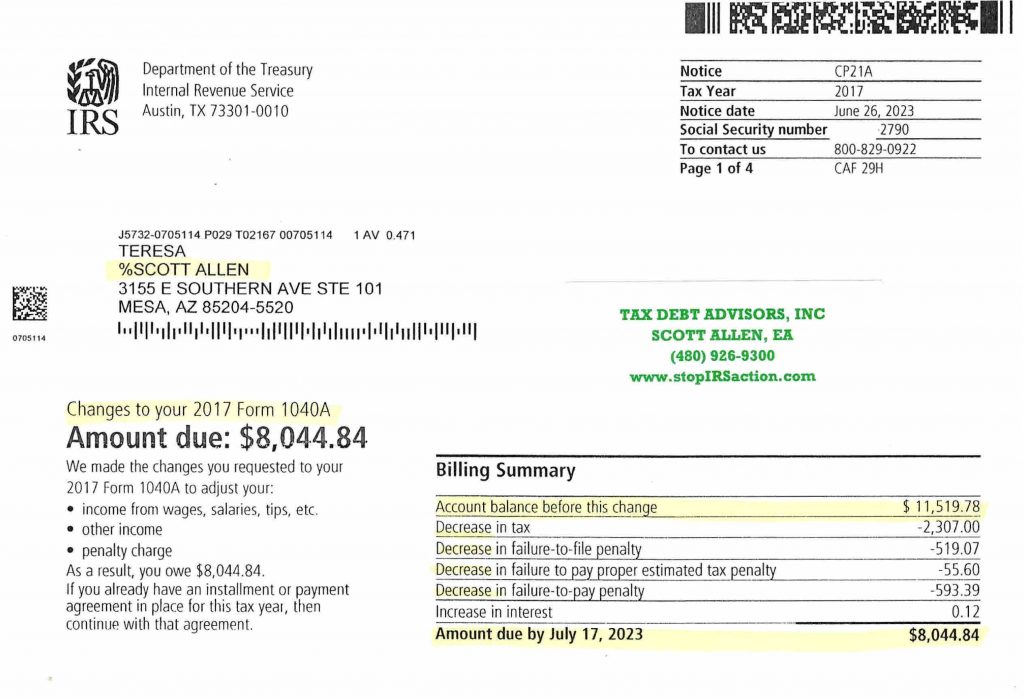

Example Case: Scott Allen EA of Tax Debt Advisors, Inc. was able to represent Teresa and get her some much needed Phoenix AZ IRS tax relief on her 2017 tax return filing. By protesting and making some corrections on her 2017 taxes saved her nearly $3,500 in back taxes owed. You will see the correction and approal letter from the IRS below. Again, if you need help resolving back taxes owed or filing of back tax returns give Scott Allen EA a call.