No more Mesa AZ IRS Garnishment

How to stop a Mesa AZ IRS Garnishment

Yes, a Mesa AZ IRS garnishment can be stopped and in many cases it can be stopped before your next paycheck. The IRS will issue garnishment notice to your employer when you owe them for unpaid back taxes and/or behind on filing your tax returns. Your employer is required by law to withhold a chunk of your paycheck and send it to the IRS. Often times it can be as much as 30-40% of your take home pay. Your employer will respond to the Mesa AZ IRS garnishment notice until the debt is fully satisfied or they receive a notice of release of levy. Its always better to get compliant with the IRS before a garnishment notice is sent out but if that isn’t the case you still have options.

How to get the IRS to send out a notice of release of levy to an employer?

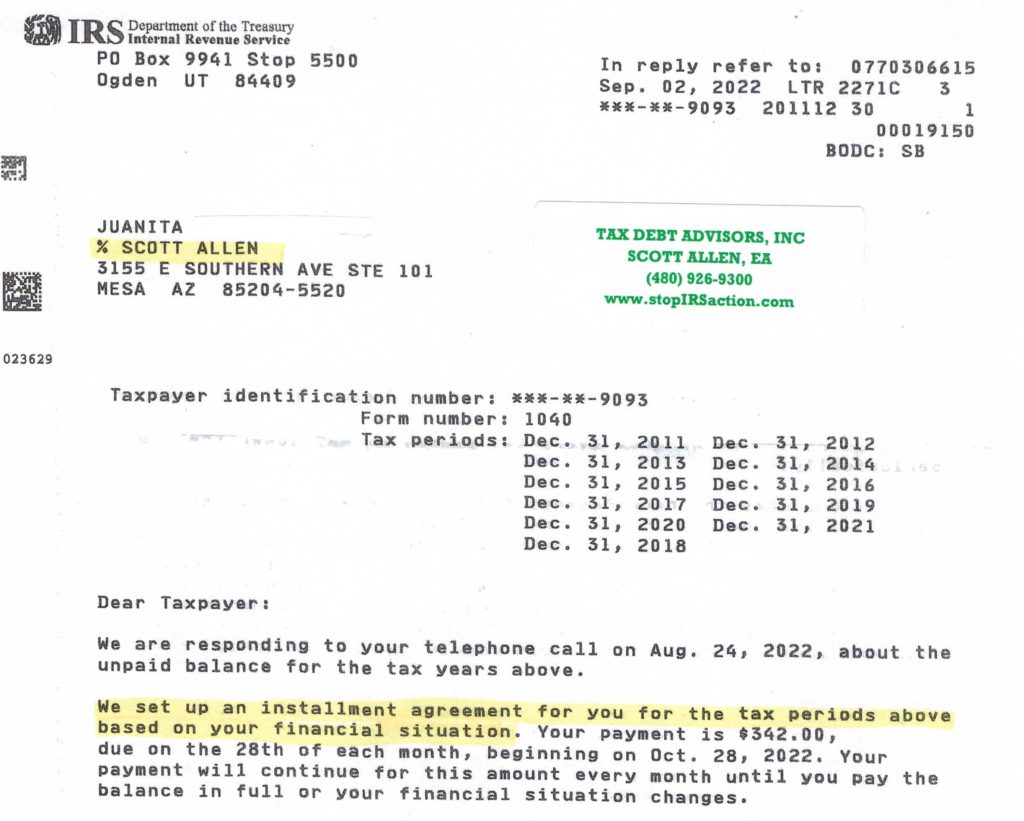

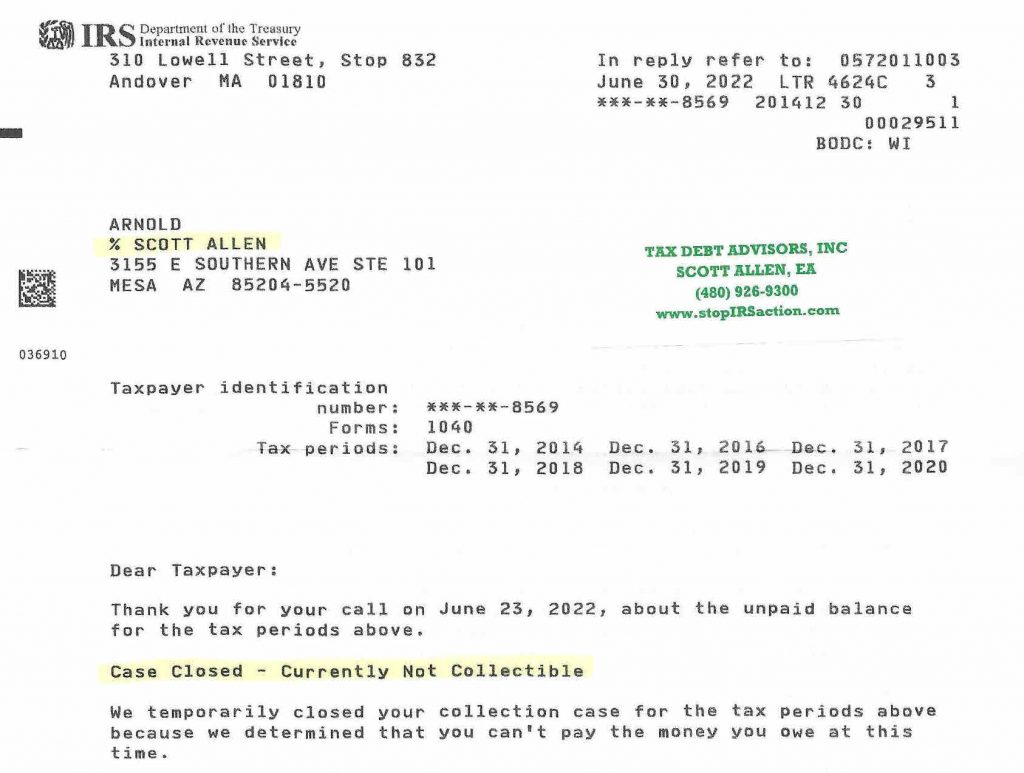

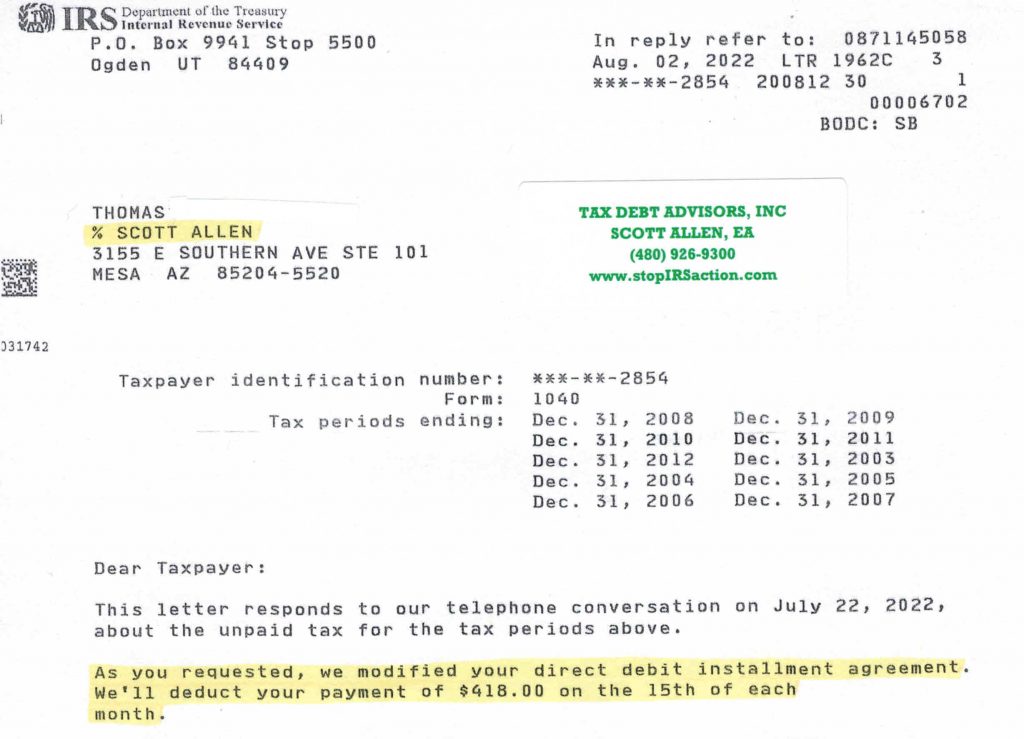

In one sentence, you need to get compliant! Scott Allen EA of Tax Debt Advisors Inc can help you do so. To get the IRS to issue a notice of release on the Mesa AZ IRS garnishment an agreement needs to be negotiated and approved by the IRS. An agreement could be a currently non collectible status, a payment plan, or an agreement to full pay in 90 days to give you some examples. Once the IRS approves an agreement they have to send out a release of levy to your employer. Scott Allen EA will typically do most of this work over the phone with the IRS to expedite the process. By mail, things can take weeks to happen. Most taxpayers do not have weeks to wait as their next paycheck may only be a few days away. Time is of the essence and Scott Allen EA understands this. He will work into the evening if it means you have a shot as getting 100% of your next paycheck.

Have Mesa AZ back tax returns to file?

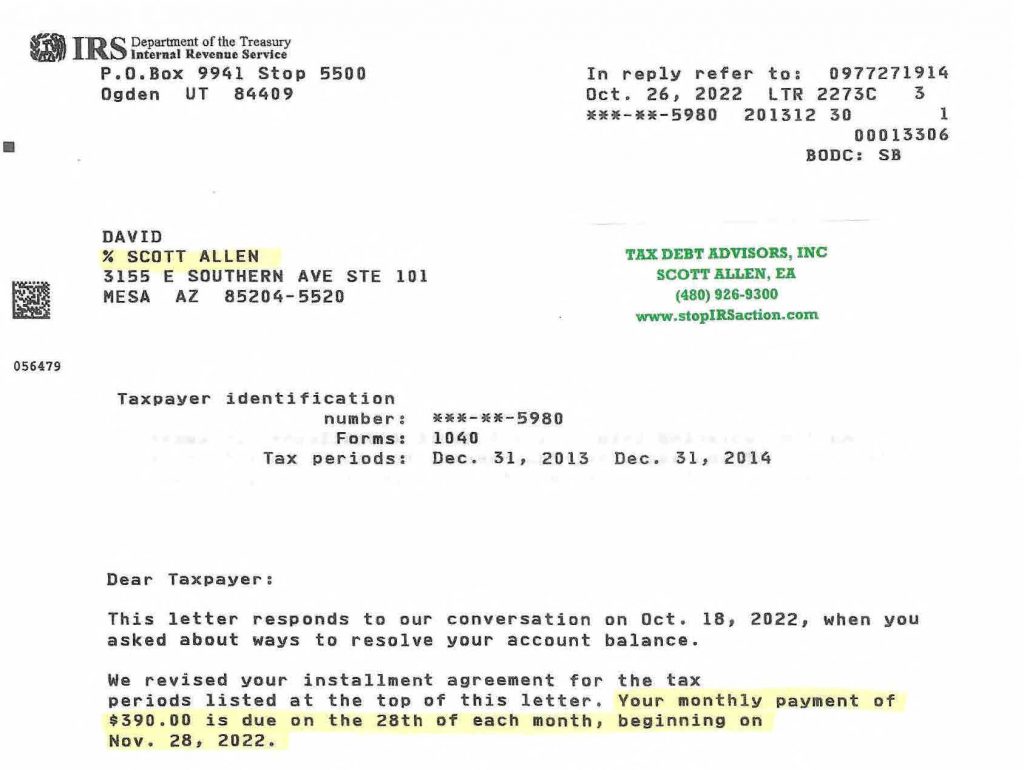

Scott Allen EA of Tax Debt Advisors, Inc also specializes in the filing of back tax returns. Whether you need one return or seven tax returns filed Scott can help. As your IRS power of attorney in this process he will represent you from start to finish to make sure everything is done right, and right the first time! Feel free to give him a call and schedule a free initial consultation. That is exactly what David did and he was thrilled with the result. He received a Mesa AZ IRS garnishment notice but rather than having the IRS suck 32% of his take home pay Scott was able to negotiate his back taxes into a very manageable $390/month payment plan. This was all negotiated before his next payday and David’s wages were never garnished. Both years he owes for are included into that arrangement. Take a look as the IRS approval notice below. No more Mesa AZ IRS garnishment to worry about for David!