Addressing IRS Tax Lien in Scottsdale, AZ

Let Tax Debt Advisors, Inc help address your IRS Tax Lien in Scottsdale, AZ

A dark cloud hovers over your financial stability when you receive a notice of a tax lien from the Internal Revenue Service (IRS). If you’re in Scottsdale, AZ, and find yourself in this situation, don’t fret. Let’s demystify an IRS tax lien in Scottsdale, AZ and explore how you can effectively address it, with the help of a trusted ally like Tax Debt Advisors, Inc.

What is an IRS Tax Lien?

A tax lien is the government’s legal claim against your property when you neglect or fail to pay a tax debt. This lien encumbers all your assets (like property, securities, vehicles) and could even extend to future assets acquired during the lien’s duration.

An IRS tax lien in Scottsdale, AZ can create substantial financial challenges, including negative impacts on your credit score, making it harder to secure loans or lines of credit. The lien remains until you pay your tax debt in full, or until the IRS is no longer legally able to collect the debt.

A Five-Step Action Plan to Address IRS Tax Liens

1. Don’t Ignore the Notice

Ignoring the IRS notice can lead to severe repercussions, like the IRS seizing your property to settle the debt. Always respond promptly.

2. Verify the Lien

Start by understanding the tax lien notice. Ensure the debt amount is accurate, and if you believe there’s an error, contact the IRS immediately. You can request a copy of the lien document from the county recorder’s office in Maricopa County, if necessary.

3. Evaluate Your Options

After verifying the debt, you should explore available options to address the lien. These could include:

- Paying the tax debt in full: This is the most straightforward method, but it’s often not feasible for those with significant debts.

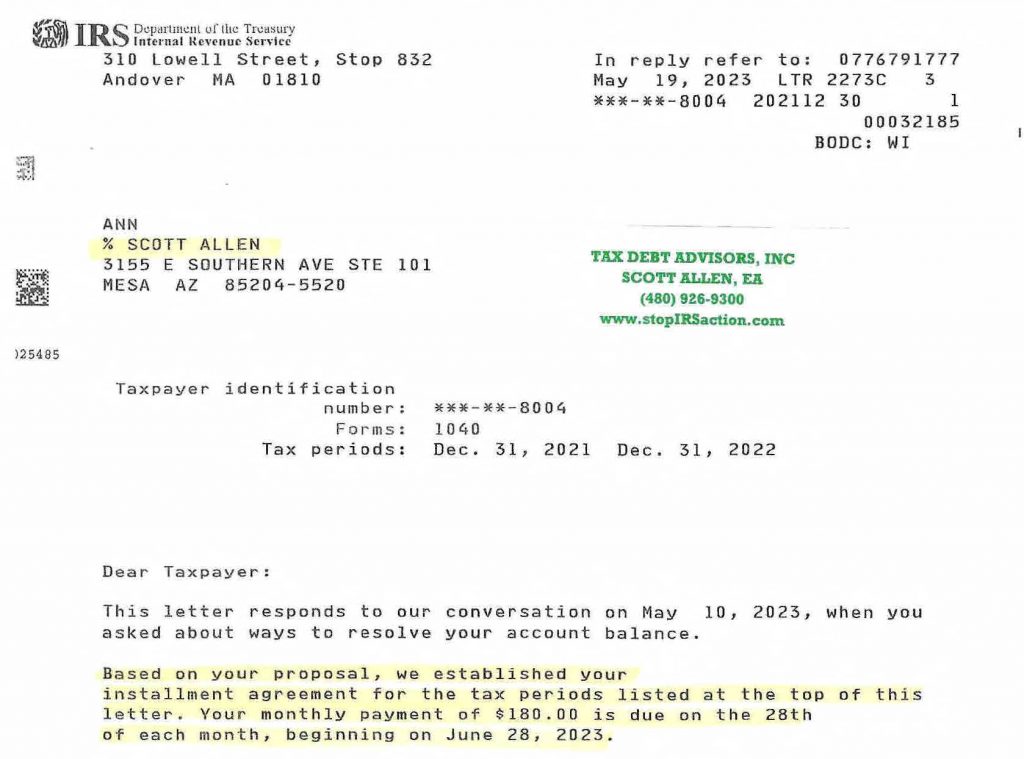

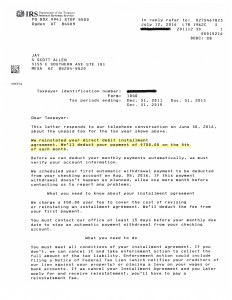

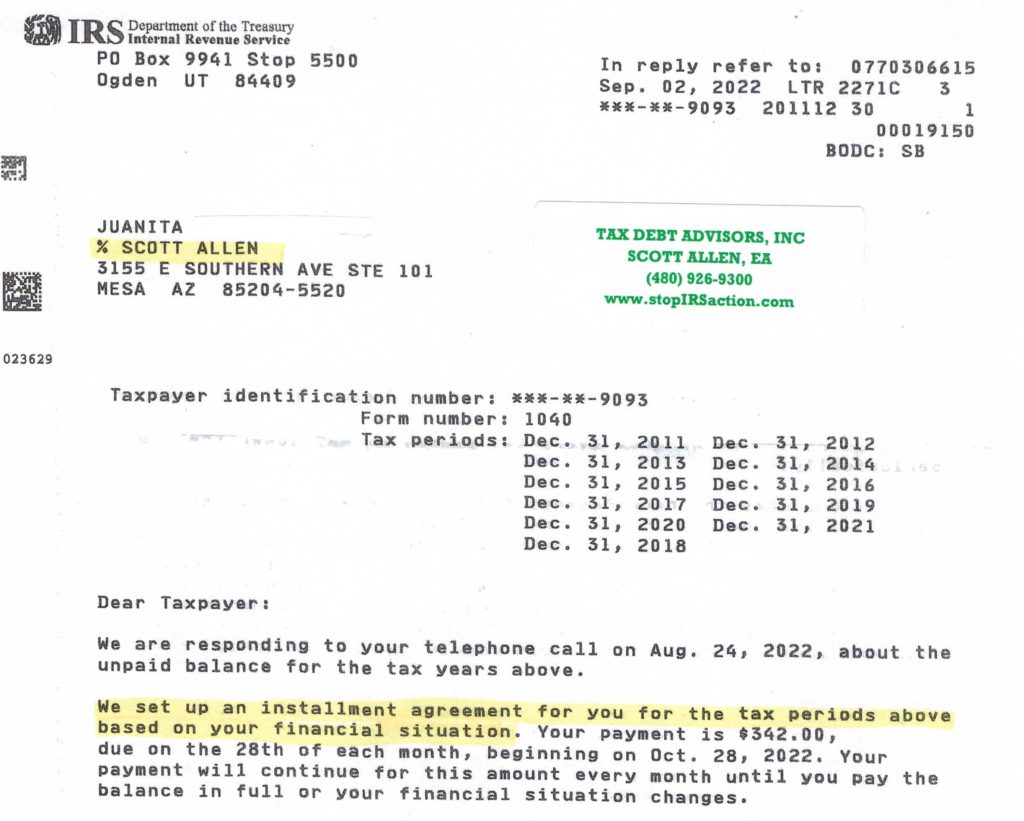

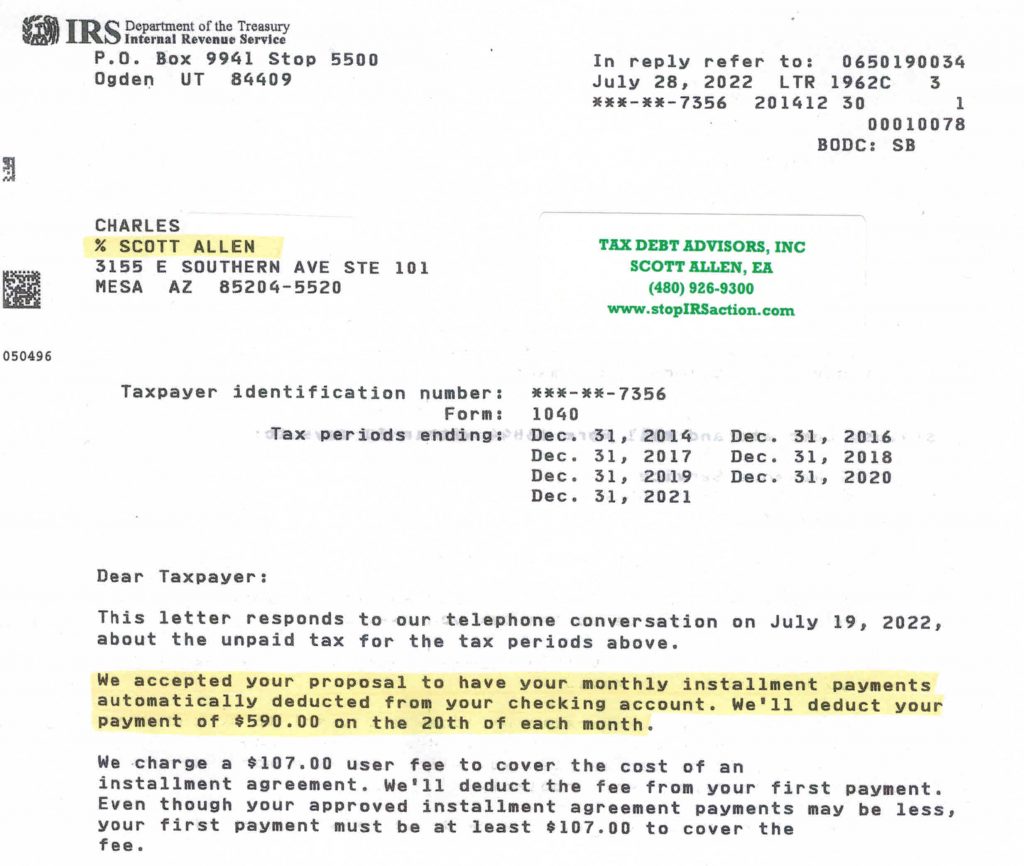

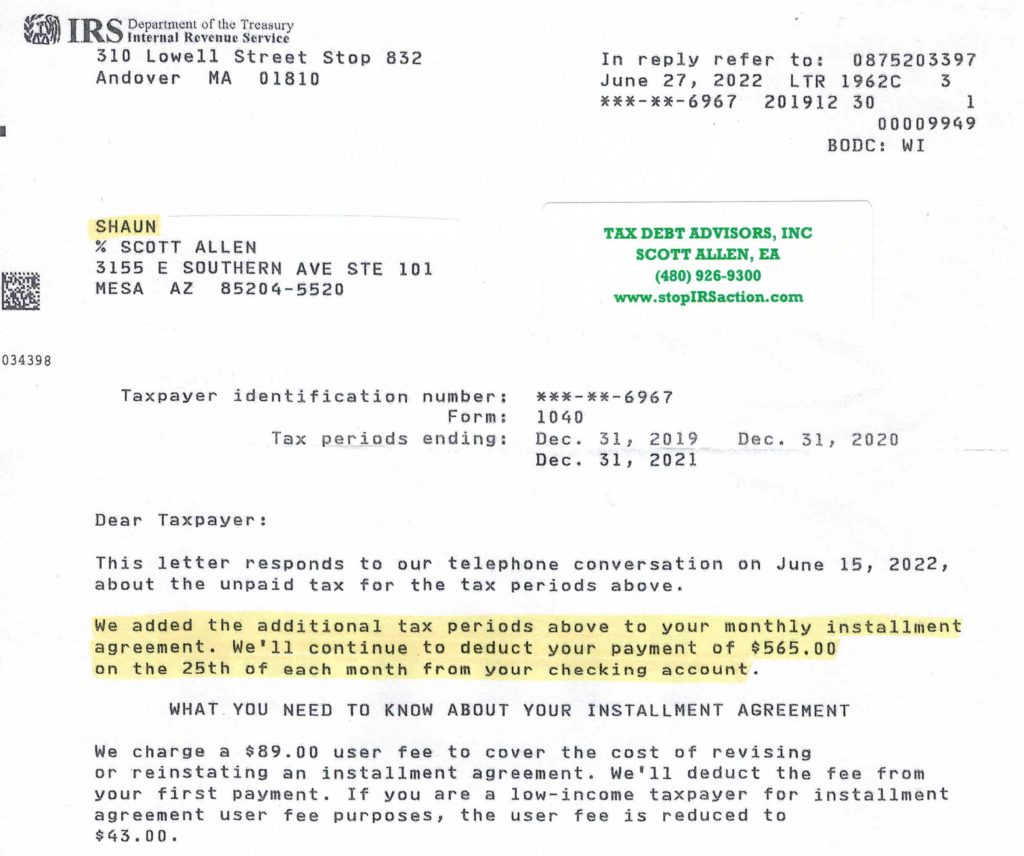

- Setting up a payment plan with the IRS: Installment agreements allow you to pay your debt over time.

- Applying for a Offer in Compromise (OIC): An OIC allows you to settle your tax debt for less than the full amount you owe.

- Discharge of property: This removes the lien from specific property.

- Subordination: Although it doesn’t remove the lien, subordination allows other creditors to move ahead of the IRS, which can make it easier to get a loan or mortgage.

- Withdrawal: Withdrawal removes the public Notice of Federal Tax Lien and assures the IRS is not competing with other creditors for your property.

4. Develop a Plan

Once you’ve identified your options, the next step is to create an action plan. This might include negotiating with the IRS, setting up a payment plan, or disputing the lien if you believe it’s incorrect.

5. Hire a Tax Professional

Tax matters can be complex, and the stakes are high. Hiring an experienced tax professional like Tax Debt Advisors, Inc. can make the process more manageable and increase your chances of success.

Why Should You Hire Tax Debt Advisors, Inc.?

Located near Scottsdale, Tax Debt Advisors, Inc. has been successfully resolving IRS tax liens and other tax-related issues since 1977. Here are some reasons to consider their expertise:

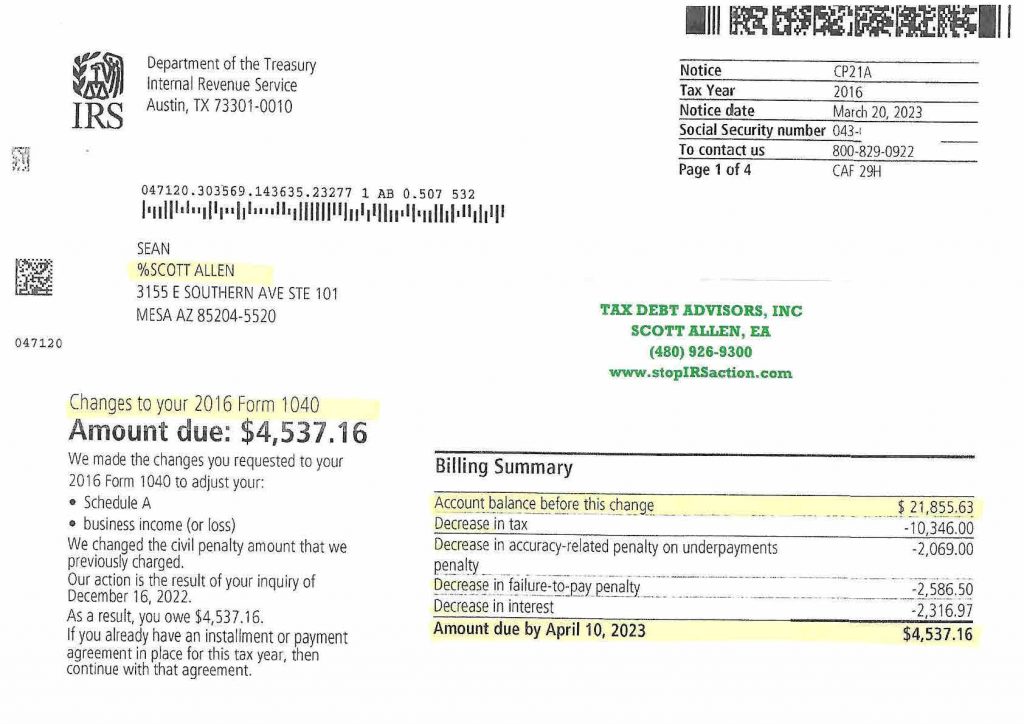

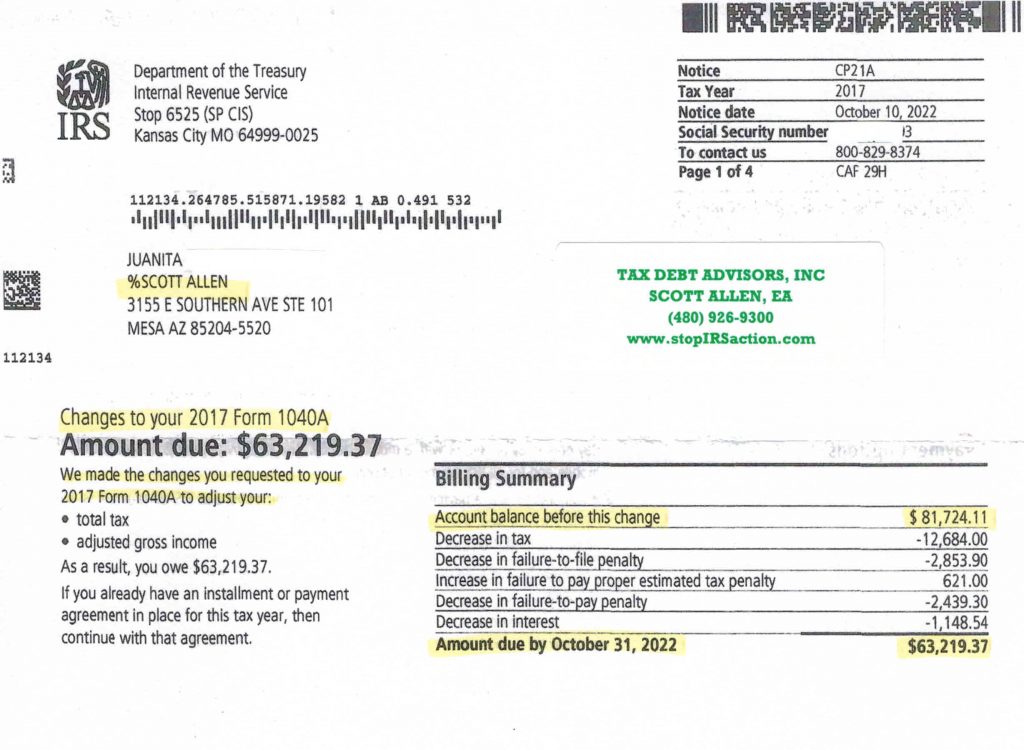

1. Experience and Knowledge: With over four decades of experience, Tax Debt Advisors, Inc. knows the ins and outs of the IRS. They can help identify the best strategies to manage your IRS tax lien in Scottsdale, AZ, given your unique financial situation.

2. Representation: The team at Tax Debt Advisors, Inc. can represent you before the IRS, reducing stress and ensuring that your rights are protected.

3. Negotiation Skills: Whether you’re considering an installment agreement or an offer in compromise, having a seasoned negotiator on your side can make a significant difference.

4. Peace of Mind: Knowing a professional is handling your tax matters allows you to focus on other areas of your life without constant worry about the looming tax debt.

5. Proven Results: Tax Debt Advisors, Inc. has a strong track record of resolving tax liens and other tax issues for their clients. Their success stories are testament to their dedication and expertise.

The thought of dealing with an IRS tax lien can be daunting. But, with the right assistance and careful planning, you can navigate this challenge effectively. If you find yourself facing an IRS tax lien in Scottsdale, AZ, consider partnering with Tax Debt Advisors, Inc. Their experience, professionalism, and personalized approach can make a world of difference as you work towards resolving your tax debts. Your peace of mind is worth it.