Filing Back IRS Tax Returns Mesa Arizona

One of the hardest events to watch over the last 45 years has been the number of potential tax clients who believe what they want to hear. Literally thousands of vulnerable individuals and families that have to file back IRS tax returns Mesa Arizona are taken in by companies, mostly out of state that sell a promise that they almost never keep. Most of the companies being referred to have now gone out of business or filed for bankruptcy, leaving their victims owing the IRS even more than before they retained their services.

Before you consider using a company out of state to file Mesa AZ back IRS tax returns, consider a free consultation with a local firm in Mesa, Arizona. Scott Allen E.A. has the expertise to help your from your very first initial consultation which is free and without obligation. Call Scott Allen E.A. at 480-926-9300 and schedule an appointment.

And now, The Allegory of the Cave.

Plato—(427 BC –347 BC)

The Allegory of the Cave from The Republic.

The allegory of the cave is used by the Greek philosopher Plato in this work, The Republic. The allegory of the cave originated with Socrates and is also known as the Myth of the Cave.

Imagine prisoners who have been chained since early childhood deep inside a cave. Not only are their limbs immobilized by the chains, their heads are chained in one direction as well so that their gaze is fixed only on the wall in front of them. They cannot remember a time when they were not a prisoner. In fact they don’t even know they are prisoners. As far as they are concerned, their situation is completely normal. They are satisfied with their life because the cave is all they know.

Behind the prisoners is an enormous fire and between the fire and the prisoners is a raised walkway with puppets of various animals, plants and other things that are moved back and forth. The puppets cast shadows on the wall and the prisoners watch these shadows. When one of the puppets carriers speaks, an echo against the wall causes the prisoners to believe that the words come from the shadows.

The prisoners engage in what appears to us to be a game of naming the shapes as they come by. This, however, is the only reality they know—seeing mere shadows of images. They are thus conditioned to judge the quality of each others intelligence by their skill in quickly naming the shapes.

One day a prisoner is released and compelled to stand up and turn around. At that moment his eyes are blinded by the sunlight coming into the cave. When the prisoner leaves the cave he can see all the objects perfectly from the light of the sun and not just mere shadows on the wall. He actually sees the real thing for the first time.

Once enlightened, the freed prisoner desires to return to the cave to free his fellow prisoners. He tries to describe the brilliance of the light and the beauty of the things he has seen. The prisoners soon tire of his nonsense and kill him. They prefer the pictures on the wall which is the only world they know and understand.

This allegory is very powerful. Most of us are happy with our lot and do not want to change. This is especially true with the way we think. When someone comes along with a new idea we often “kill” that idea because it is outside of our past experience. We are content just watching the shadows instead of seeing reality.

John Lennon, a former member of the Beatles, makes reference to this allegory in his song, “Watching the Wheels.” In his song, Lennon declares his willful decline from the “limelight” world of the Beatles and serves as a reminder that not all who come to us with their so called reality are helpful.

People say I’m lazy, dreaming my life away,

Well, they give me all kinds of advice designed to enlighten me.

When I tell’em that I’m doing fine, watching the shadows on the wall

“Don’t you miss the big time, boy? You’re no longer on the ball.”

Plato Quotes

A hero is born among a hundred, a wise man is found among a thousand, but an accomplished one might not be found even among a hundred thousand men.

Be kind, for everyone you meet is fighting a hard battle.

Never discourage anyone…who continually makes progress, no matter how slow.

The price good men pay for indifference to public affairs is to be ruled by evil men.

We can easily forgive a child who is afraid of the dark; the real tragedy of life is when men are afraid of the light.

You can discover more about a person in an hour of play than in a year of conversation.

No evil can happen to a good man, either in life or after death.

For a man to conquer himself is the first and noblest of all victories.

Honesty is for the most part less profitable than dishonesty.

I shall assume that your silence gives consent.

No one knows whether death, which people fear to be the greatest evil, may not be the greatest good.

Man—a being in search of meaning.

Necessity…the mother of invention.

Nothing in the affairs of men is worthy of great anxiety.

The beginning is the hardest part of any work.

The measure of a man is what he does with power.

There are three classes of men; lovers of wisdom, lovers of honor, and lovers of gain.

There is no harm in repeating a good thing.

We are twice armed if we fight with faith.

Wise men speak because they have something to say; Fools because they have to say something.

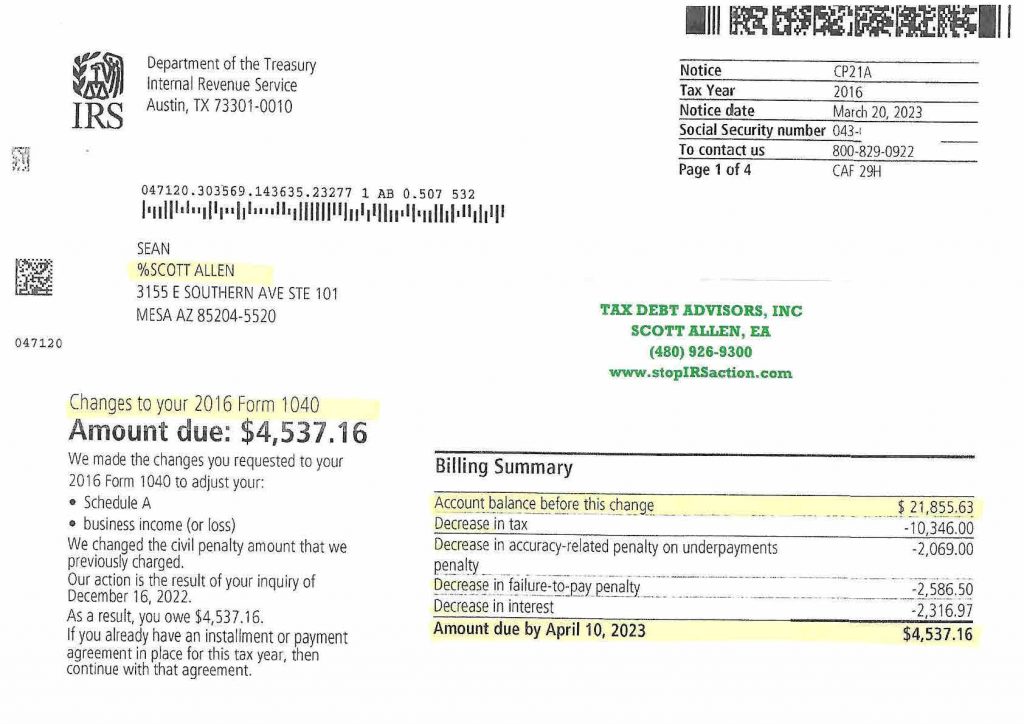

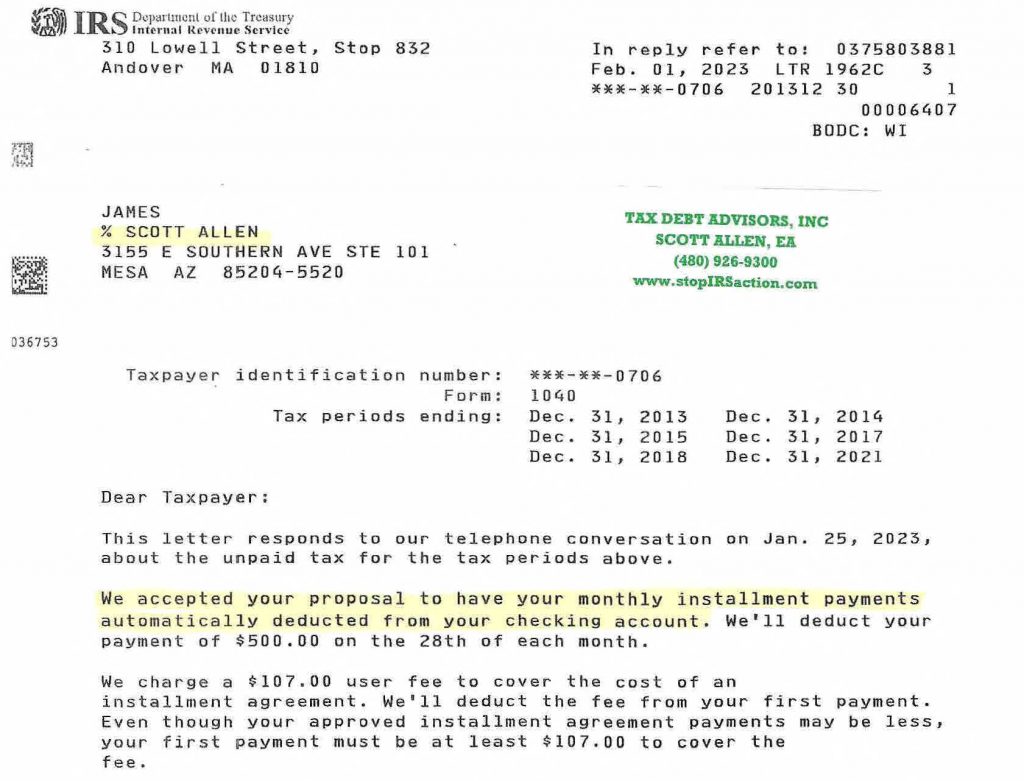

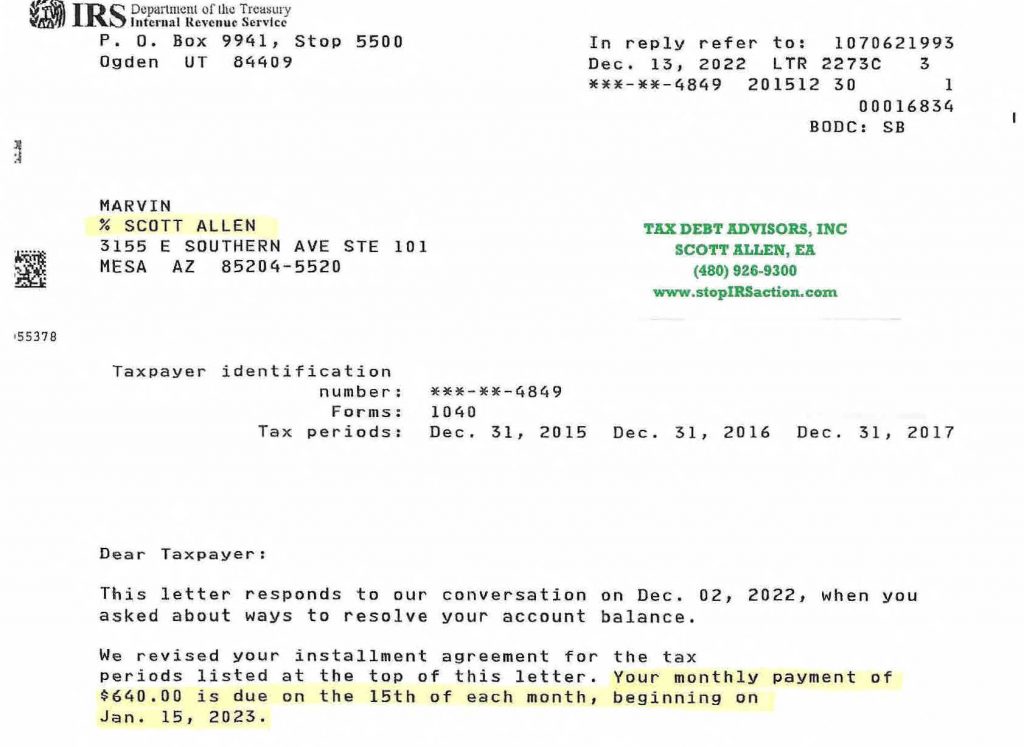

Seriously consider how important it is for you to find the right person to help you file back IRS tax returns Mesa Arizona. Scott Allen E.A. has witnessed the success of his family’s IRS resolution practice first hand and is carrying on the tradition to the second generation. Tax Debt Advisors, Inc. has been helping individuals like you with IRS tax problems since 1977.

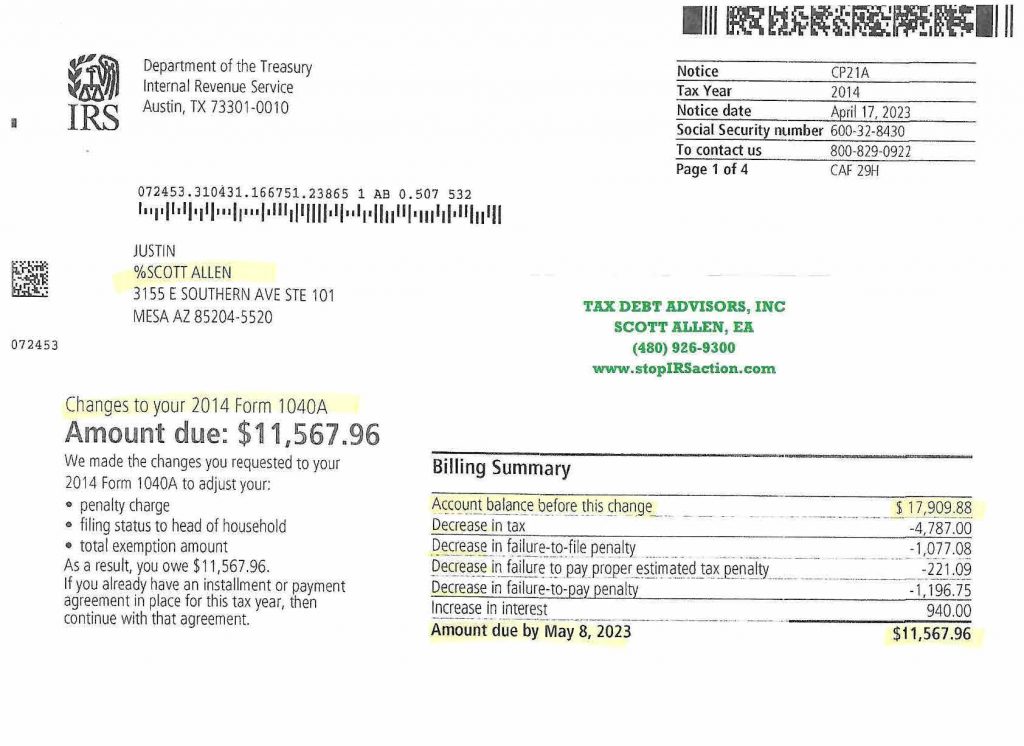

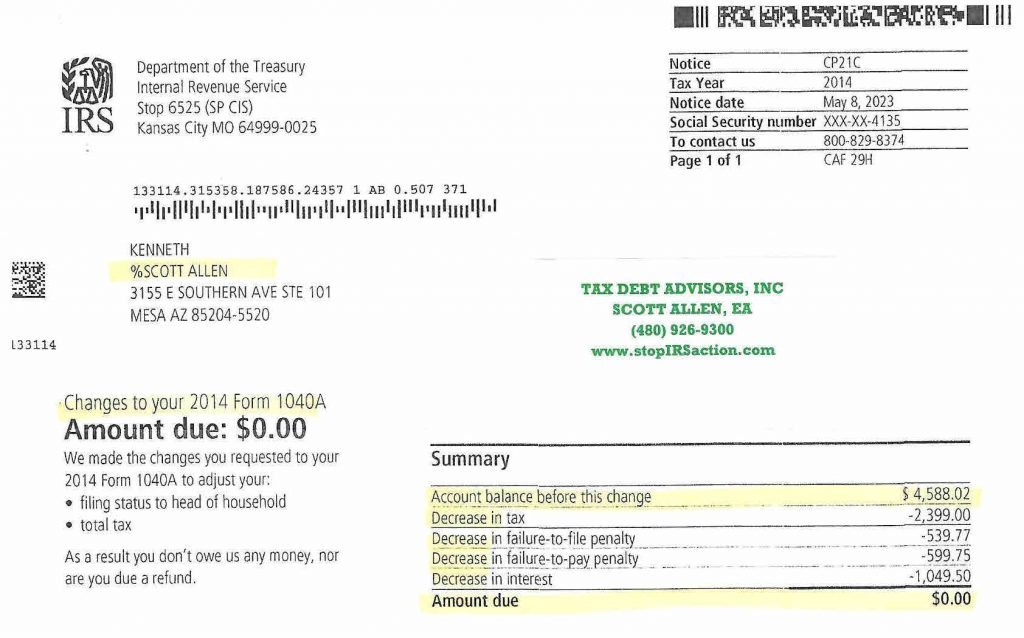

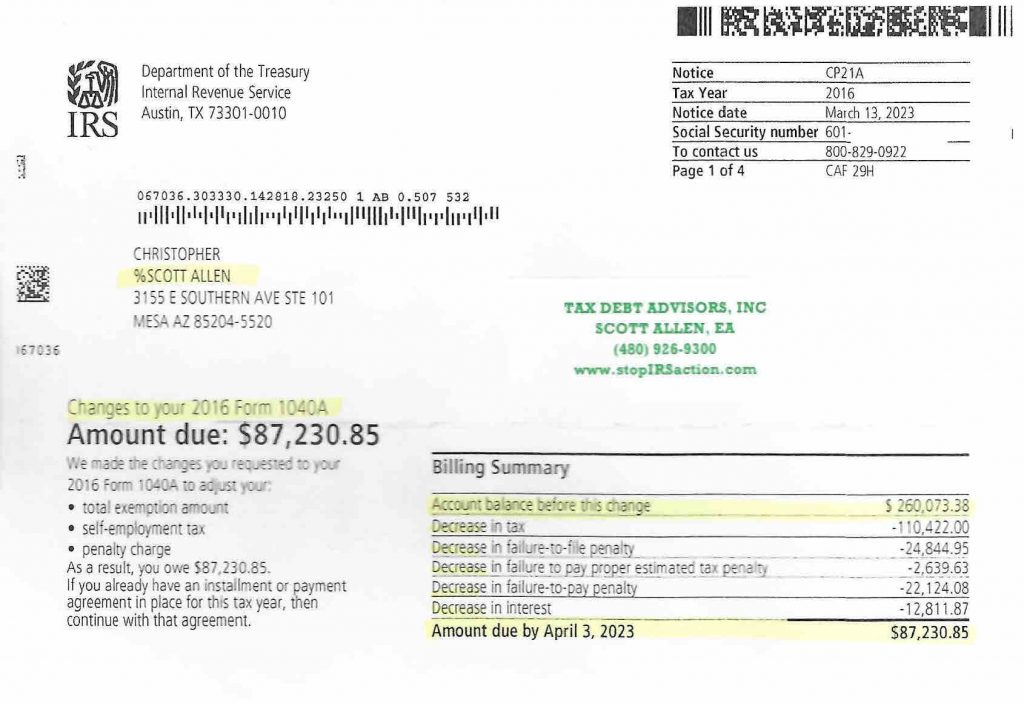

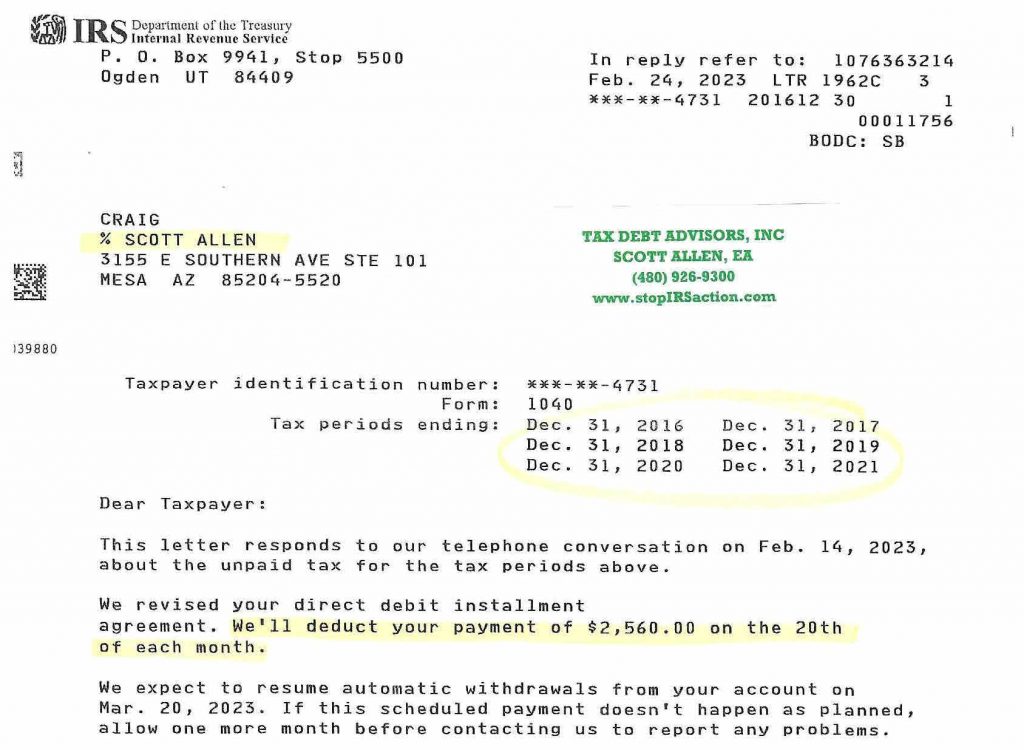

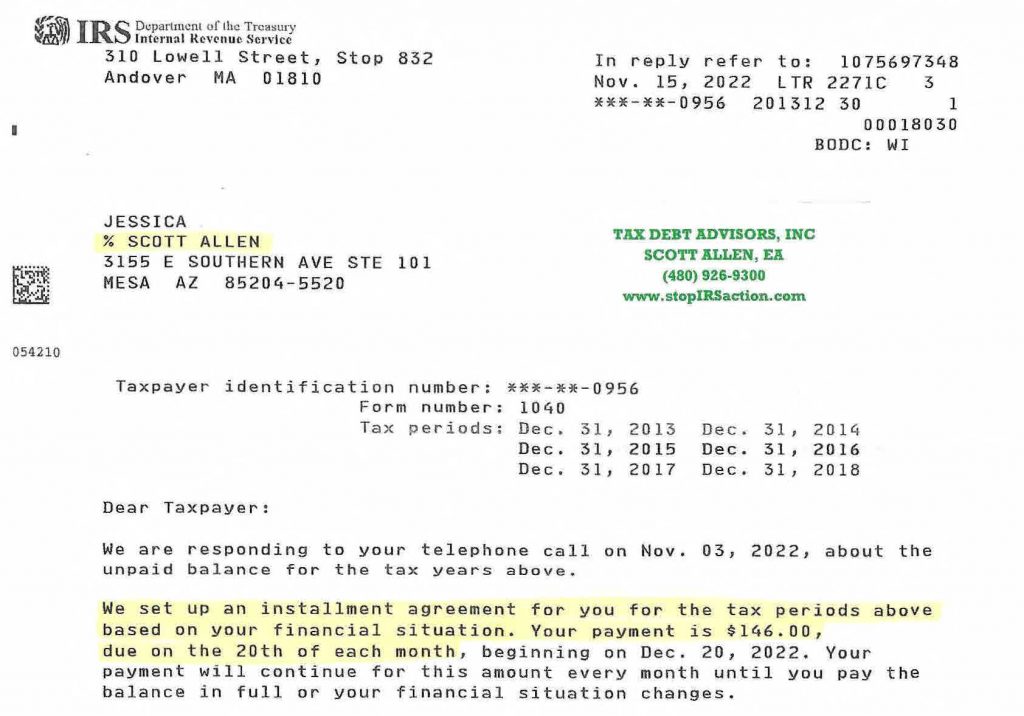

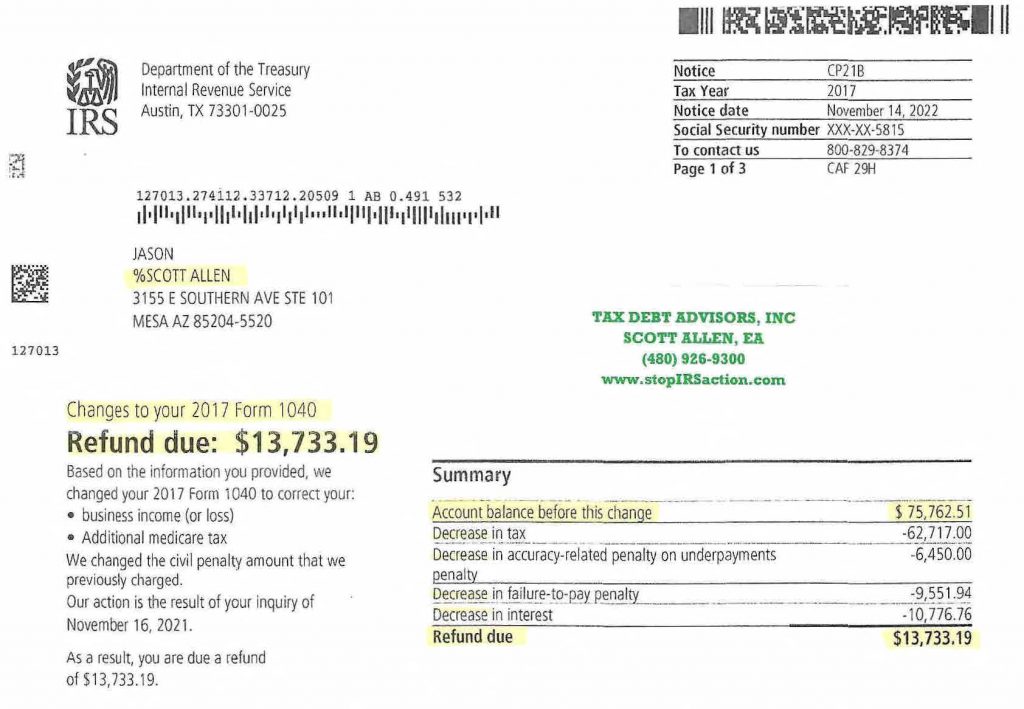

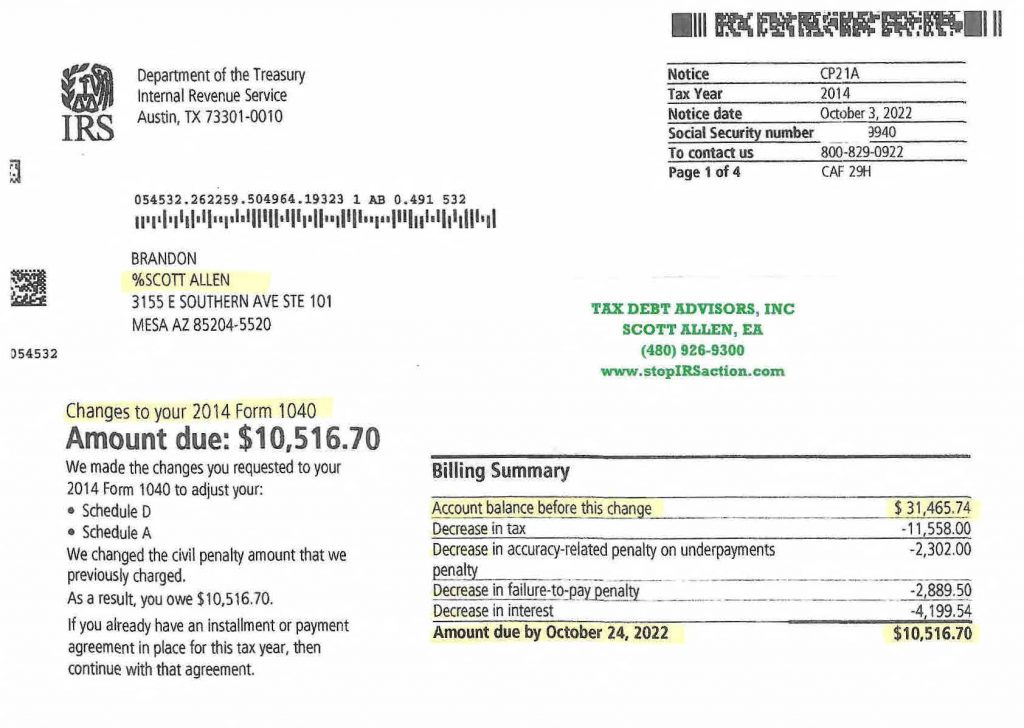

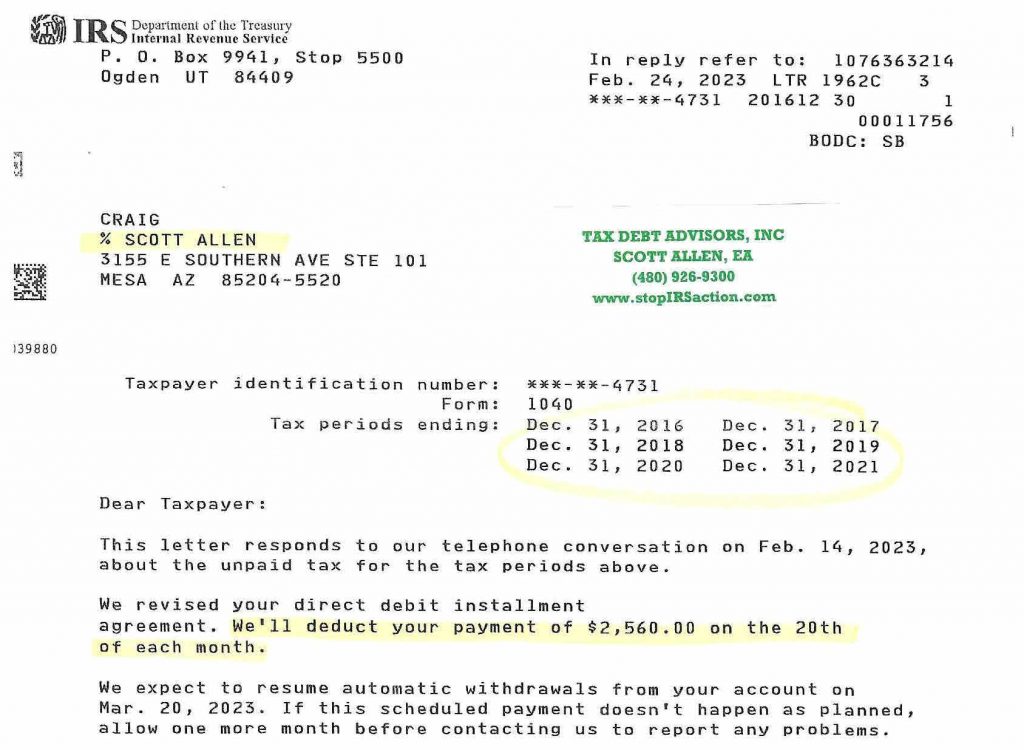

Below is a recent success story on how Scott Allen EA help his client Craig with filing back IRS tax returns Mesa Arizona. He was six years behind and was owing the IRS over $200,000 in back taxes. This was a tough case to handle from beginning to end but it was done with great success. Anytime a taxpayer is going to owe the IRS more then six figures they become a bit more aggressive on collections. Scott Allen EA was able to settle all of Craig’s back taxes owed into a monthly payment plan of $2,560. Scott can represent you before the IRS too and get you the best possible settlement allowable by law.

Filing Back IRS Tax Returns Mesa Arizona