File back taxes Phoenix AZ & reduce liability

Can you file back taxes Phoenix AZ to reduce your liability?

You may have to file back taxes Phoenix AZ for a number of reasons. Maybe you have never filed to begin with. Maybe you need to amend a previous filing. Maybe you need to protest a filing through audit reconsideration.

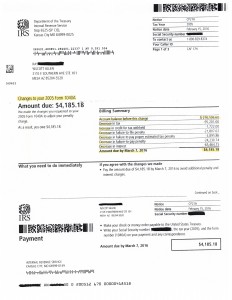

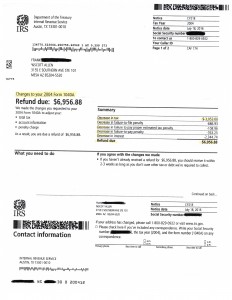

Ray was a client of Tax Debt Advisors who had many years of unfiled tax returns. The IRS had selected a couple of those years and filed tax returns in his behalf. However, the IRS filed the tax return in the quickest, easiest way possible resulting in an exaggerated high balance owed. They did not take into consideration any business expenses, cost basis of property sold, and spouse and dependents to claim.

After Scott Allen EA was able to analyze Ray’s entire picture with the IRS he began the tax preparation phase. Starting with this 2005 tax return they protested the IRS’s substitute for return filling with one of their own. As you can see by viewing the notice below that Ray’s liability was successfully reduced by well over $200,000. Congratulations Ray!

Scott Allen EA has the ability to represent you before the IRS when you file back taxes Phoenix AZ. As your power of attorney he will stop IRS action and get you in the driver seat. You will know exactly what needs to happen to get you in compliance with the Internal Revenue Service. After you are in compliance he can then negotiate a settlement with them. Scott Allen EA does not charge for an initial consultation. Don’t delay any longer what you know you need to take care of now.

More Back Taxes Filed and Reduced in 2019

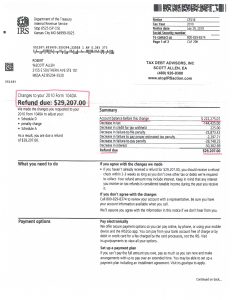

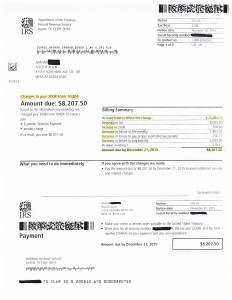

Robert was a client who was far behind in his tax preparations. So far behind that the IRS filed returns for him. When they filed his 2010 tax return he owed the IRS over $220,000.

Wow, that is a lot of money!

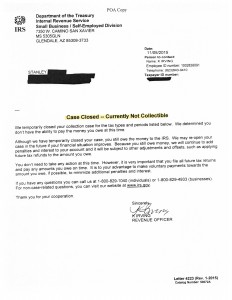

When Robert met with Scott Allen EA to file back taxes Phoenix AZ he came up with a much better outcome. The notice below will show you the results of the substitute protest filing they did.

There is good news and bad news with this result. All the taxes were able to be wiped out. In fact, the return is showing a $29,000 refund. Why might there be bad news you are thinking? The IRS has a rule that refunds expire after three years. Because Robert waited until 2019 to file this return he will not see this refund. The IRS keeps it.

Don’t be a victim of losing out on refunds. If you have unfiled tax return with the IRS, meet with Scott Allen EA of Tax Debt Advisors and get compliant right away.