Settle Back Taxes Mesa AZ: How Tax Debt Advisors, Inc. Can Help You

Settle Back Taxes Mesa AZ

Facing a significant IRS tax debt can be overwhelming. If you’re a Mesa, Arizona resident struggling to keep up with your tax obligations, you’re not alone. Tax Debt Advisors, Inc. specializes in helping taxpayers navigate complex tax issues and find the most effective solutions to resolve their outstanding tax liabilities to settle back taxes Mesa AZ.

This blog post will delve into how Tax Debt Advisors, Inc. can represent taxpayers in Mesa, AZ, assist with filing back tax returns, and negotiate favorable agreements with the IRS. We’ll also explore a recent success story where Tax Debt Advisors, Inc. helped a client, Chris, successfully settle a substantial $100,000 IRS debt into a currently non-collectible status.

Understanding Your Tax Debt

The first step in resolving any tax debt is to understand the nature and extent of the issue. Tax Debt Advisors, Inc. begins by conducting a thorough assessment of your individual tax situation. This includes:

- Reviewing all relevant tax documents: This may include past tax returns, IRS notices, and any correspondence with the IRS.

- Calculating the total tax liability: This includes the principal amount owed, accrued penalties, and interest.

- Analyzing your income and assets: This helps determine your ability to pay and identify potential eligibility for relief programs.

- Assessing your overall financial situation: This includes evaluating your income, expenses, debts, and assets to develop a comprehensive financial picture.

Representation by Tax Debt Advisors, Inc.

Tax Debt Advisors, Inc. acts as your advocate in all interactions with the IRS. This includes:

- Communicating with the IRS: We handle all communication with the IRS on your behalf, including phone calls, letters, and meetings. This shields you from the stress and potential harassment that can come from dealing with the IRS directly.

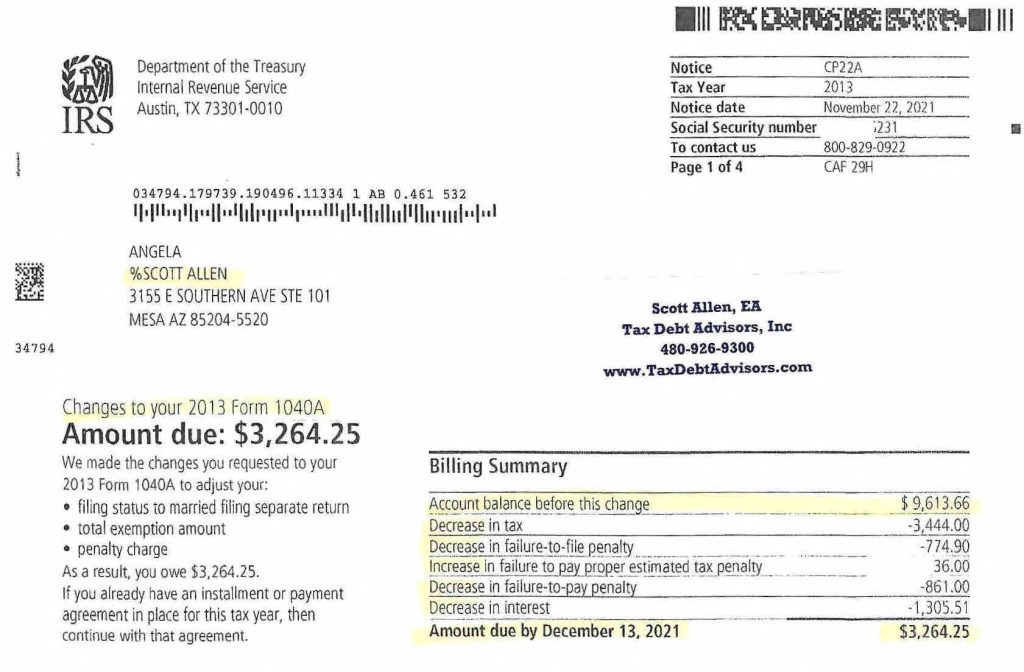

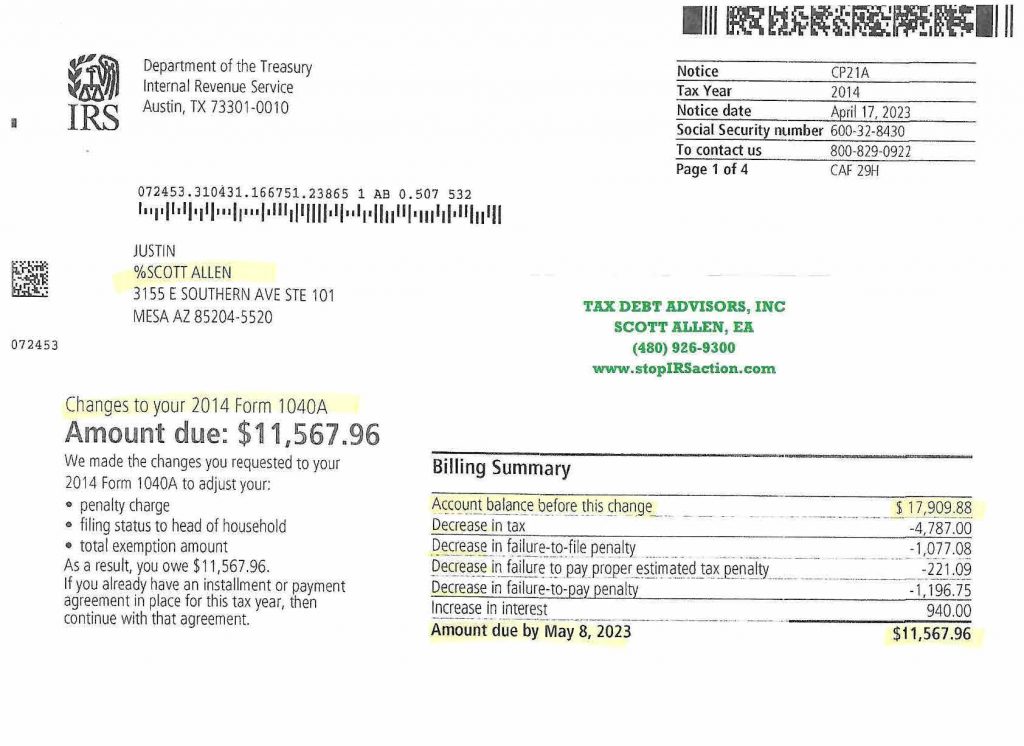

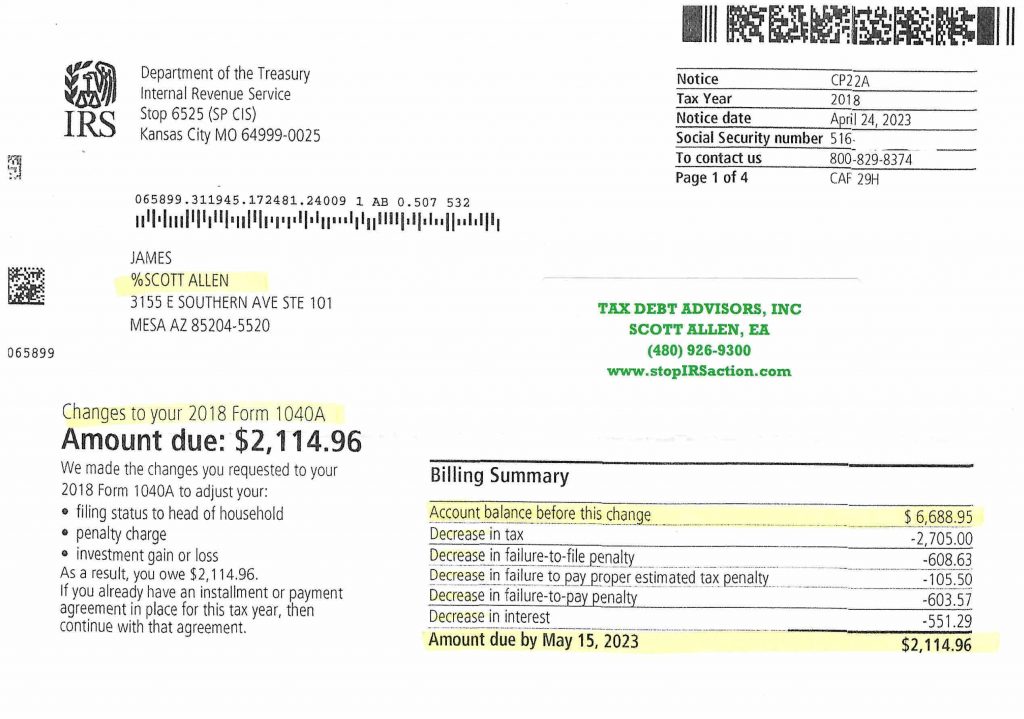

- Negotiating with the IRS: Scott Allen EA is a skilled negotiator who can effectively advocate for your best interests with the IRS. We aim to achieve the most favorable resolution possible, whether it’s a reduced tax liability, a payment plan, or a complete abatement of your debt.

- Filing necessary paperwork: We handle the preparation and filing of all necessary paperwork, such as offers in compromise, installment agreements, and appeals. This ensures that all deadlines are met and that your application is complete and accurate.

- Protecting your rights: We are well-versed in all applicable tax laws and regulations. We will ensure that your rights as a taxpayer are protected throughout the entire resolution process.

Filing Back Tax Returns

Failing to file tax returns can have serious consequences, including significant penalties and interest. If you have not filed your taxes for several years, Tax Debt Advisors, Inc. can help you:

- Prepare and file your back tax returns: Scott Allen EA can accurately and efficiently prepare and file all outstanding tax returns.

- Minimize penalties and interest: We will work to minimize the penalties and interest associated with your back taxes through various strategies, such as applying for penalty abatement.

- Develop a plan to resolve your outstanding tax liability: Once all back taxes are filed, we will work with you to develop a comprehensive plan to resolve your outstanding tax liability.

Negotiating Agreements with the IRS

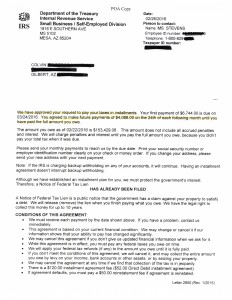

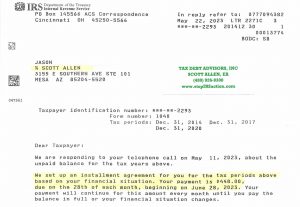

Tax Debt Advisors, Inc. can help you negotiate various agreements with the IRS to resolve your tax debt, including:

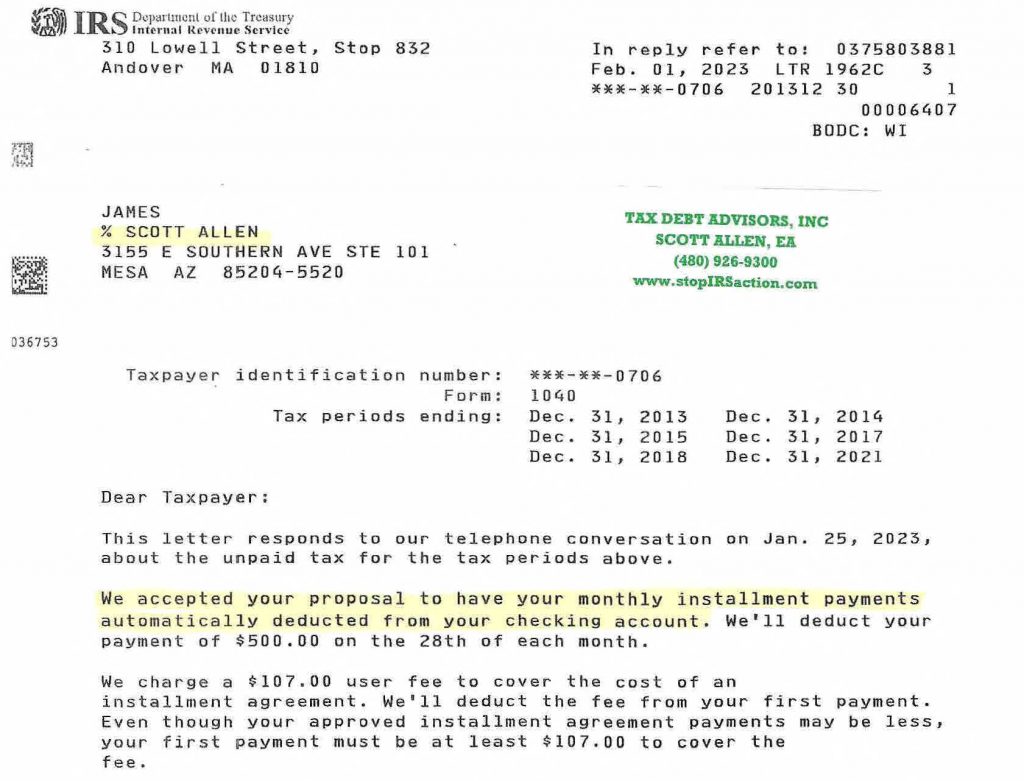

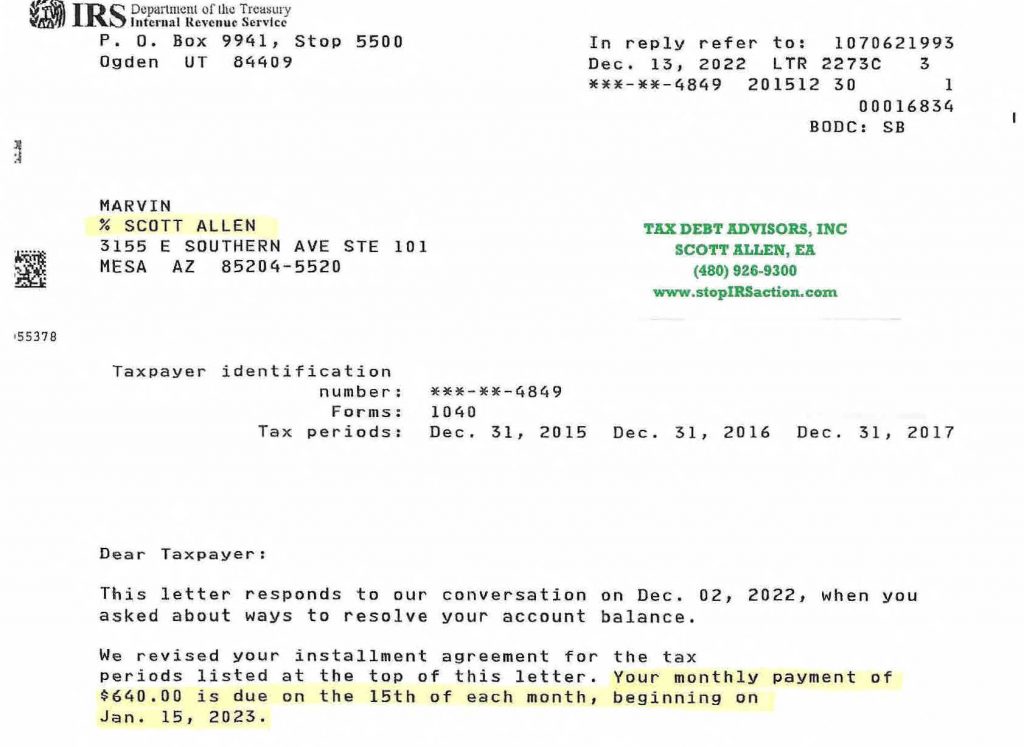

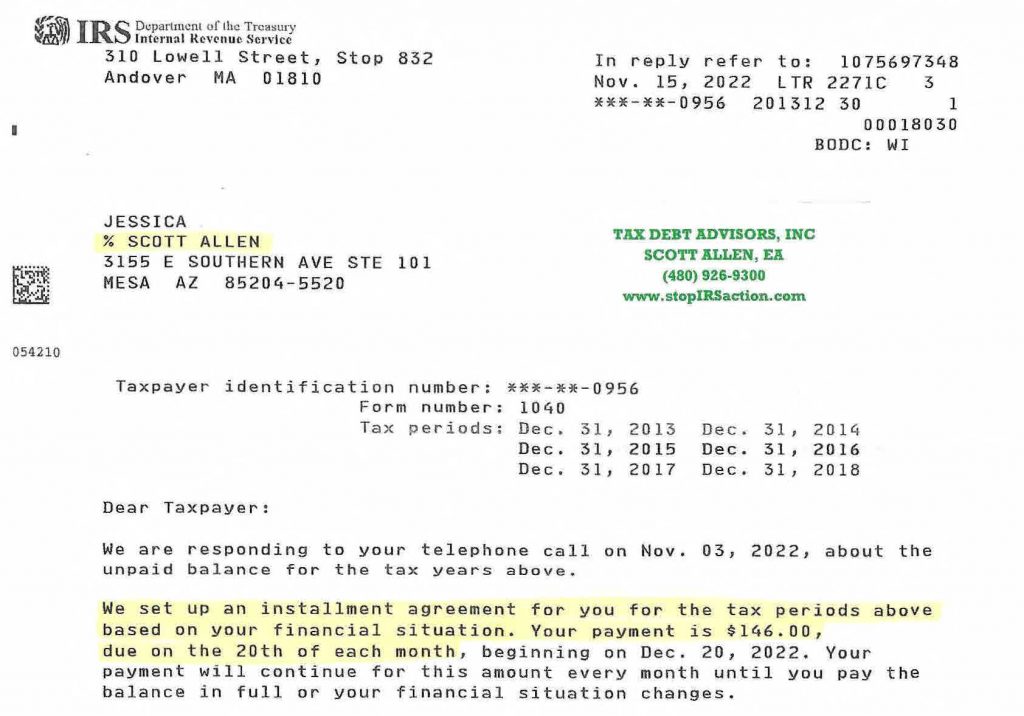

- Installment Agreements: These allow you to pay your tax debt in manageable monthly installments over an agreed-upon timeframe.

- Offer in Compromise: This allows you to settle your tax debt for an amount less than the full amount owed.

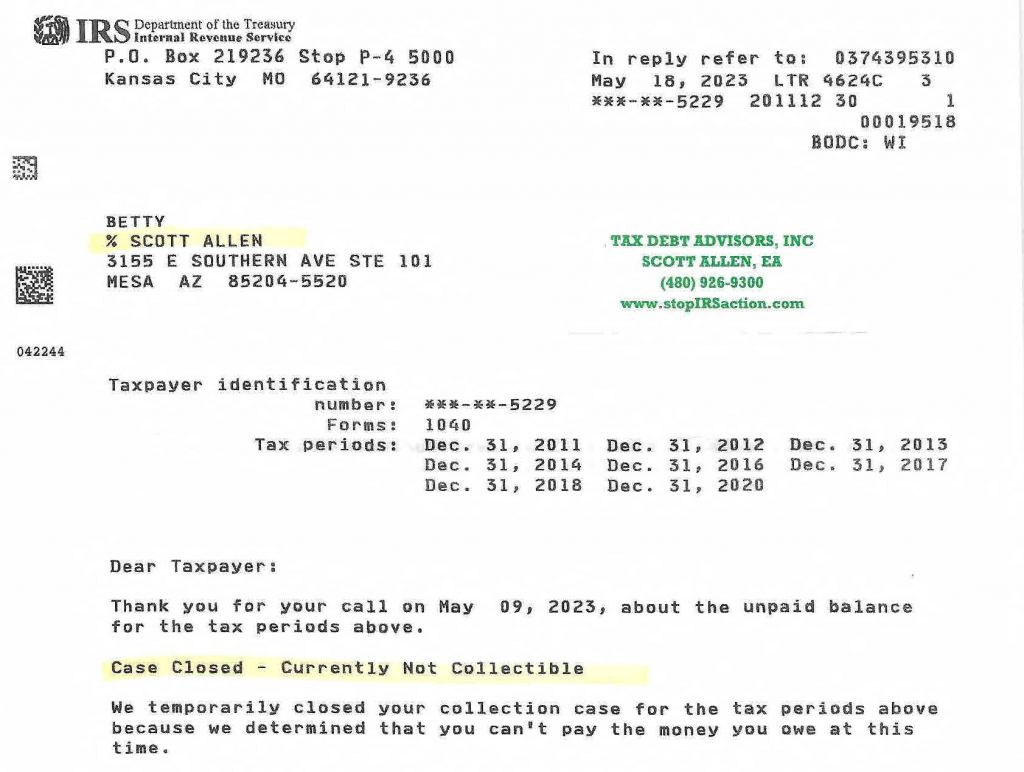

- Currently Non-Collectible (CNC) Status: If you cannot afford to pay any amount towards your tax debt, we can help you apply for CNC status, which temporarily suspends collection efforts by the IRS.

Case Study: Helping Chris Settle His $100,000 IRS Debt

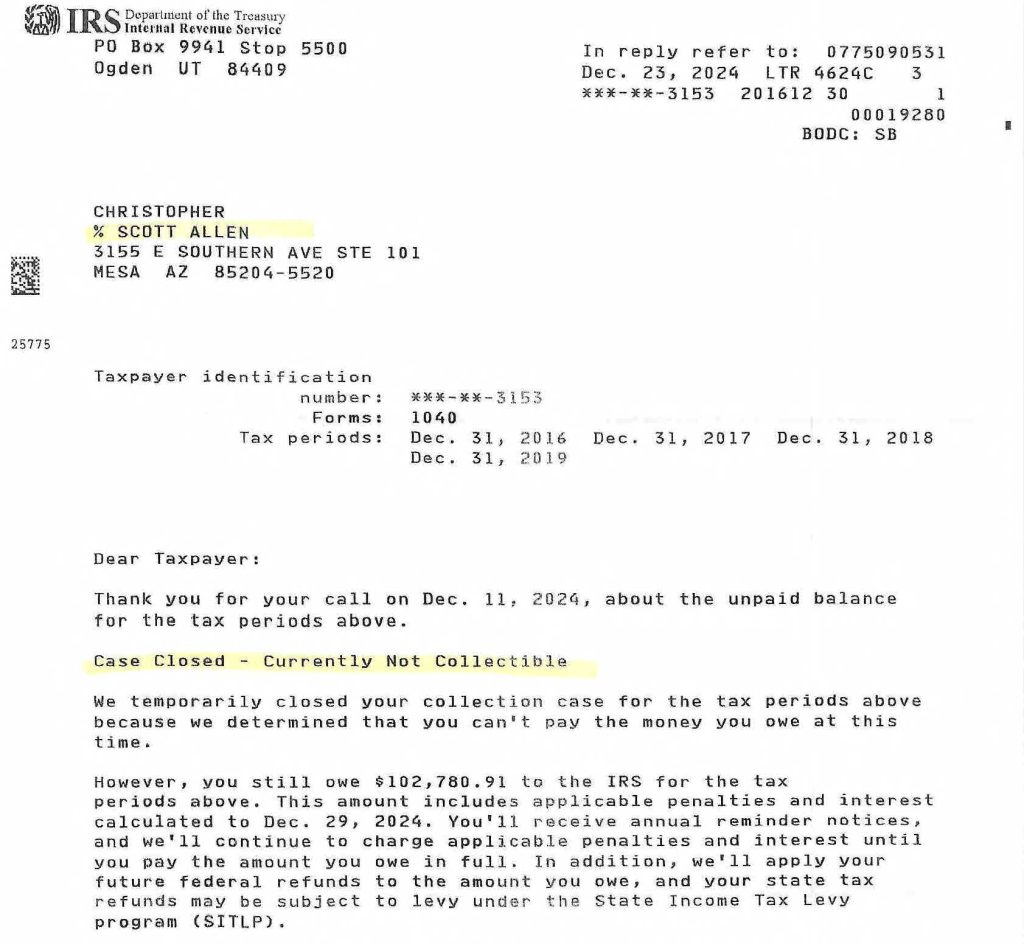

Chris, a Mesa, Arizona resident, was facing a daunting $100,000 IRS tax debt. He was overwhelmed by the situation and unsure of how to proceed. He contacted Tax Debt Advisors, Inc. for assistance.

Scott Allen EA conducted a thorough assessment of Chris’s financial situation and tax liabilities. He then worked closely with Chris to develop a comprehensive strategy to resolve his debt. After careful consideration, we determined that applying for CNC status was the most appropriate course of action for Chris’s circumstances.

We prepared and submitted the necessary documentation to the IRS on Chris’s behalf. After a thorough review, the IRS granted Chris CNC status. This provided Chris with much-needed relief and allowed him to focus on rebuilding his financial stability. See a copy of the IRS approval of the agreement below. This is how Scott Allen EA settled back taxes Mesa AZ for his client.

Why Choose Tax Debt Advisors, Inc.?

- Experienced and knowledgeable professionals: Our team comprises highly experienced tax professionals with a deep understanding of tax laws and IRS procedures.

- Personalized service: We provide personalized attention to each client, ensuring that their unique needs and circumstances are fully addressed.

- Results-oriented approach: We are committed to achieving the best possible outcome for our clients, whether it’s reducing their tax liability, securing a payment plan, or obtaining CNC status.

- Compassionate and supportive: We understand that dealing with tax debt can be a stressful and emotional experience. We provide compassionate and supportive guidance throughout the entire resolution process.

Contact Tax Debt Advisors, Inc. Today

If you’re struggling with IRS tax debt, don’t wait. Contact Tax Debt Advisors, Inc. today for a free consultation on how he can help you settle back taxes Mesa AZ. Scott Allen EA will be waiting for your call.