Tax Debt Advisors, Inc. Provides IRS Levy Help for Gilbert Arizona

IRS Levy Help for Gilbert Arizona

Isn’t it time to stop IRS harassing letters, phone calls and business cards stuck to your front door? Tax Debt Advisors, Inc is IRS levy help for Gilbert Arizona residents. It’s time to make an important decision—stop procrastinating because matters will only get a lot worse and more difficult to deal with the longer you wait. Clients come into our office upset that the IRS has levied their bank accounts or garnished their wages but fail to remember that they haven’t filed their returns for years, ignored several attempts to remedy the tax debt or haven’t paid the IRS tens of thousands of dollars of legitimately owed taxes. We are on your side; but admitting you have messed up is the first step towards getting the habit fixed. We have resolved over 113,000 IRS tax debts since 1977, yet a significant number of past clients get right back in trouble with the IRS after their IRS problems have been completely resolved. The reason is that the habit has not been addressed. There are as many reasons why as clients, that fall back into the IRS tar pits.

One of the unique services of Tax Debt Advisors, Inc. is to help clients resolve their tax problems permanently. Yes, there are some who get back in trouble and we are glad to resolve their tax matters a second time if necessary, but that is not what we are about. We want to fix your IRS problems the first time permanently. Call Scott Allen E.A. at Tax Debt Advisors, Inc. at 480-926-9300 and schedule a free initial consultation near Gilbert AZ today.

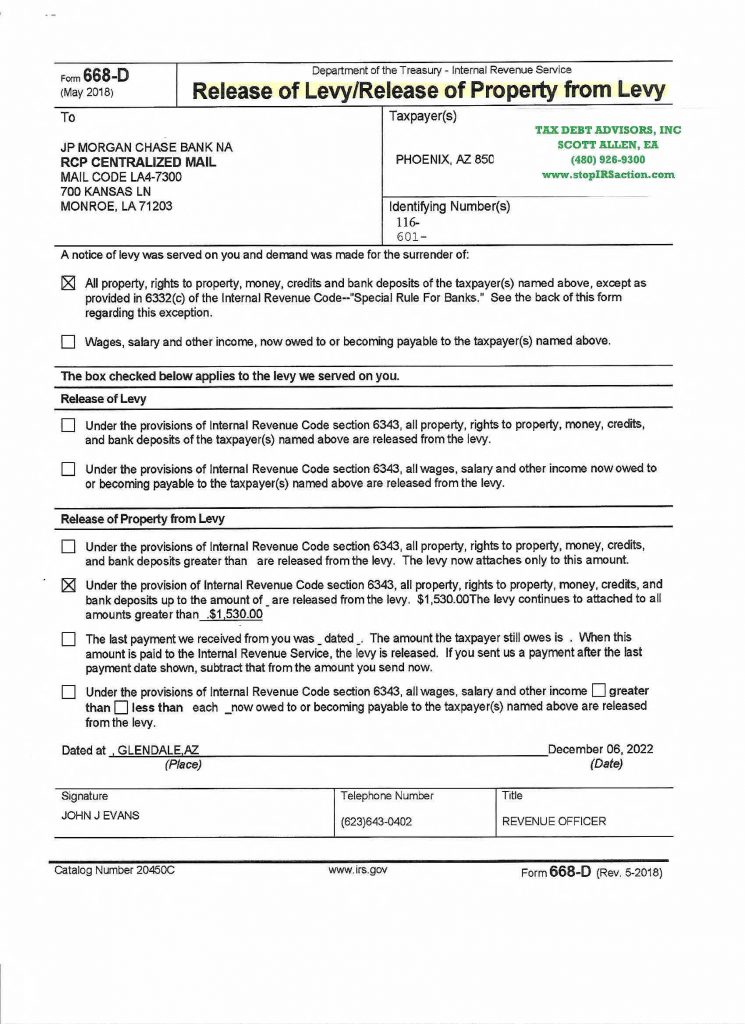

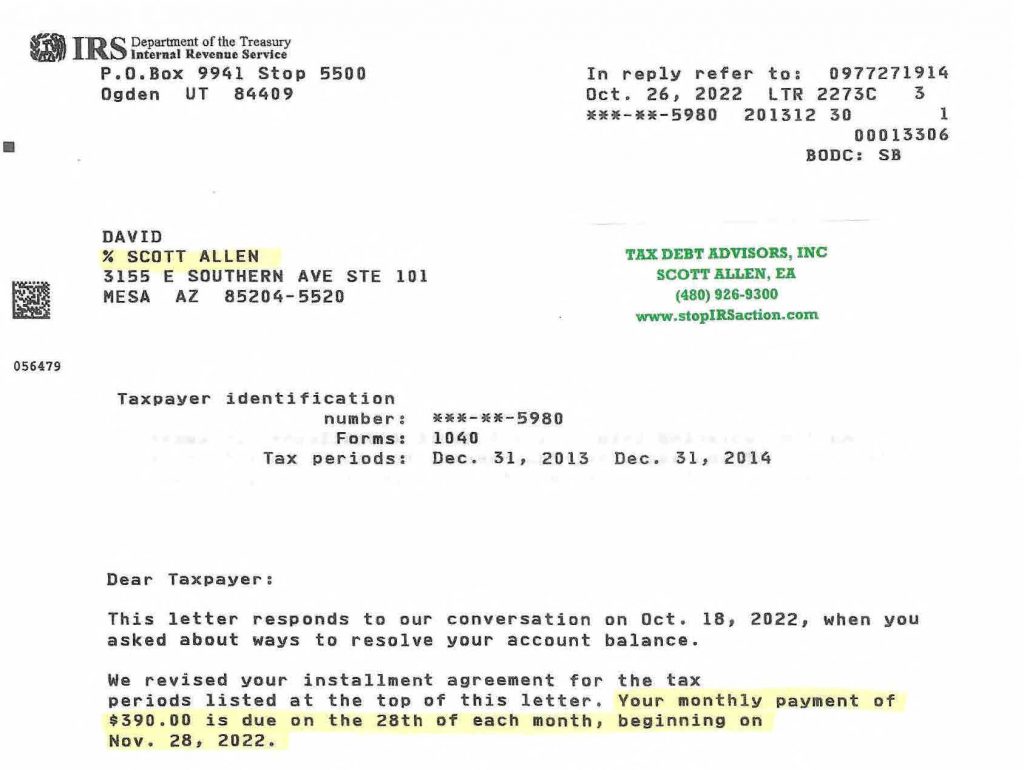

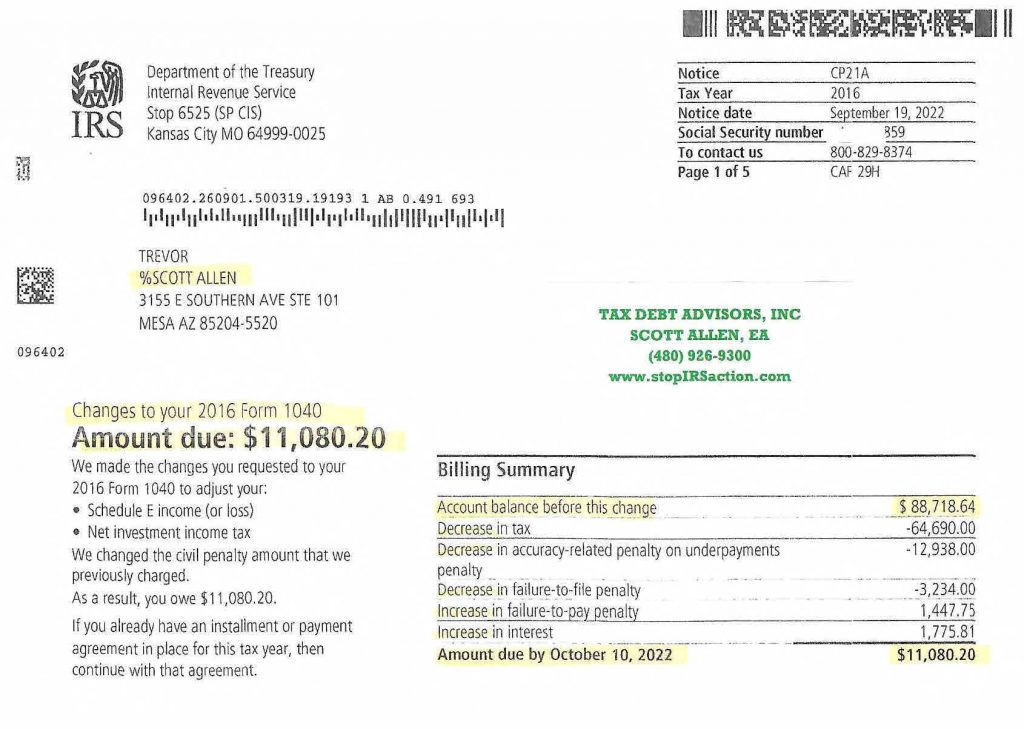

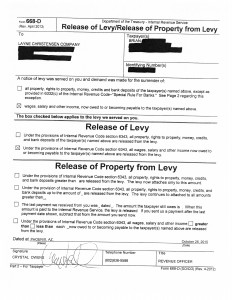

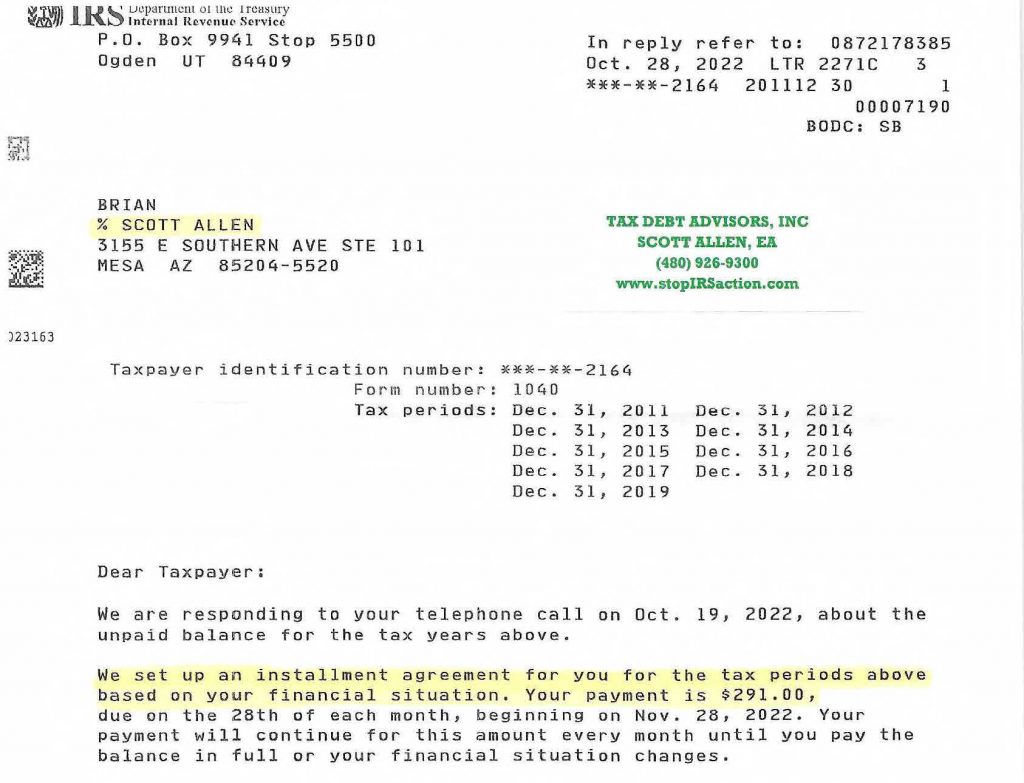

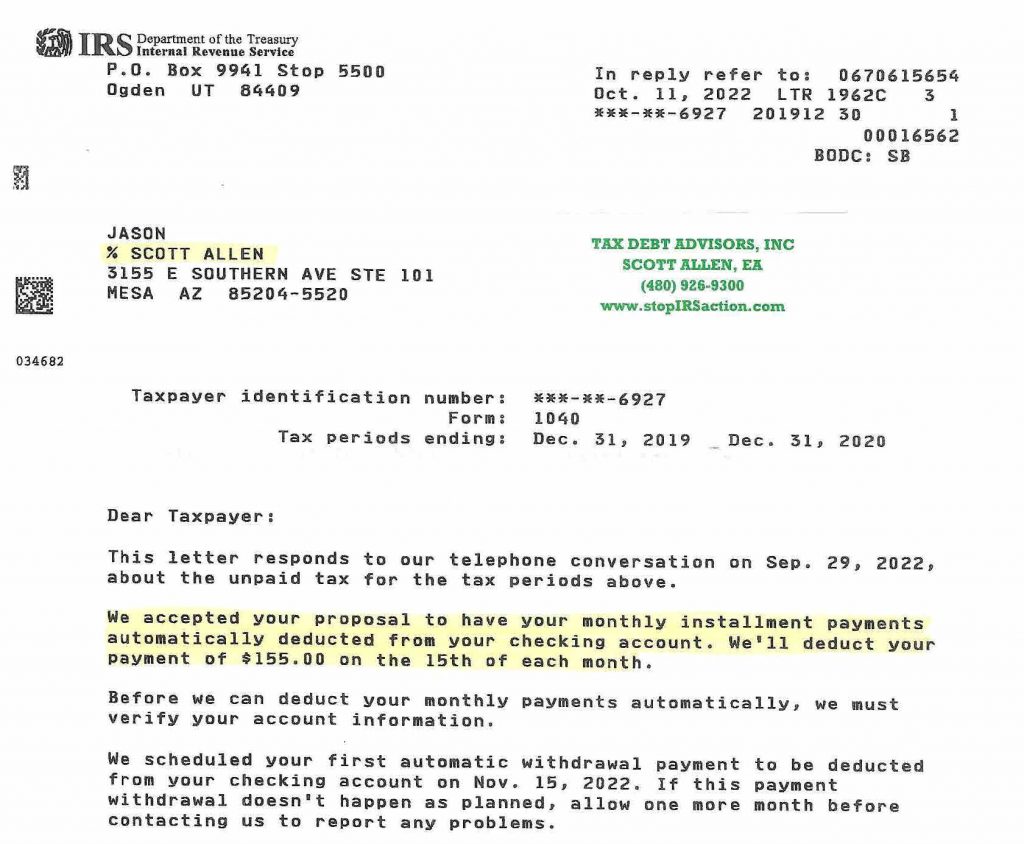

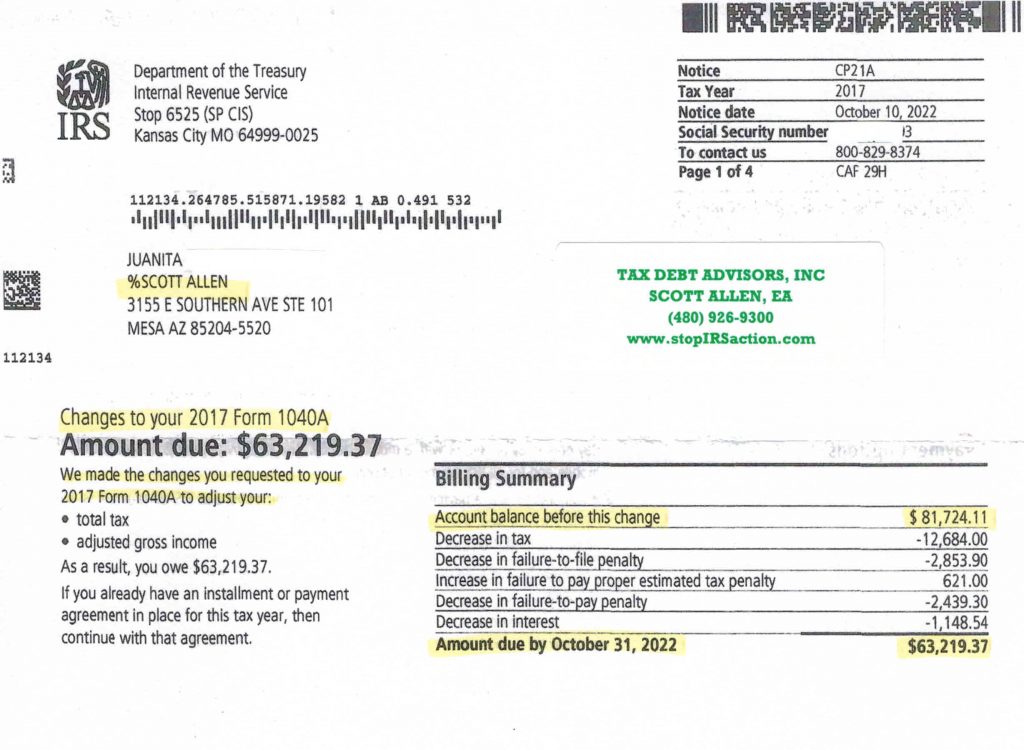

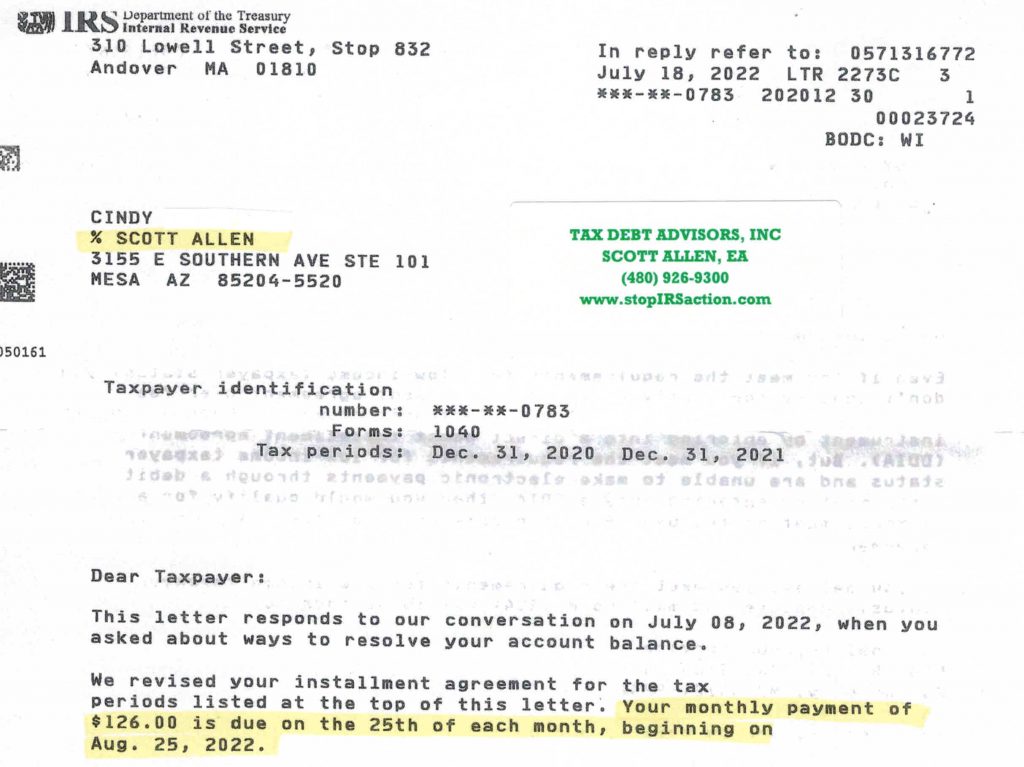

Below is a recent success Tax Debt Advisors, Inc had for a Gilbert Arizona resident that needed IRS levy help. Their personal information has been whited out, but as you can see Scott Allen EA was able to get the IRS levy placed on their bank account released the very next day after is was issued. In this situation, procrastination is what ultimately led to the bank IRS levy. This could have been avoided had the taxpayers responded to the IRS letters and phone calls. However, there is still hope even after the IRS had issued a bank or wage levy. As was mentioned earlier in this blog, for help give Scott Allen EA a call. See a copy of the IRS bank levy release below.