Facts about IRS tax liens for Arizona Residents: IRS help from Scott Allen, E.A.

Arizona IRS Tax Liens

- If the IRS ignored proper procedures, your tax lien can be removed.

- If the statute of limitations has passed the lien becomes invalid.

- Filing a bankruptcy before the lien is filed will protect exempt property forever.

- Post a bond.

- File an Offer in Compromise and making the Offer payment will remove the lien

- Get a Certificate of Subordination

- Obtain a Certificate of Release

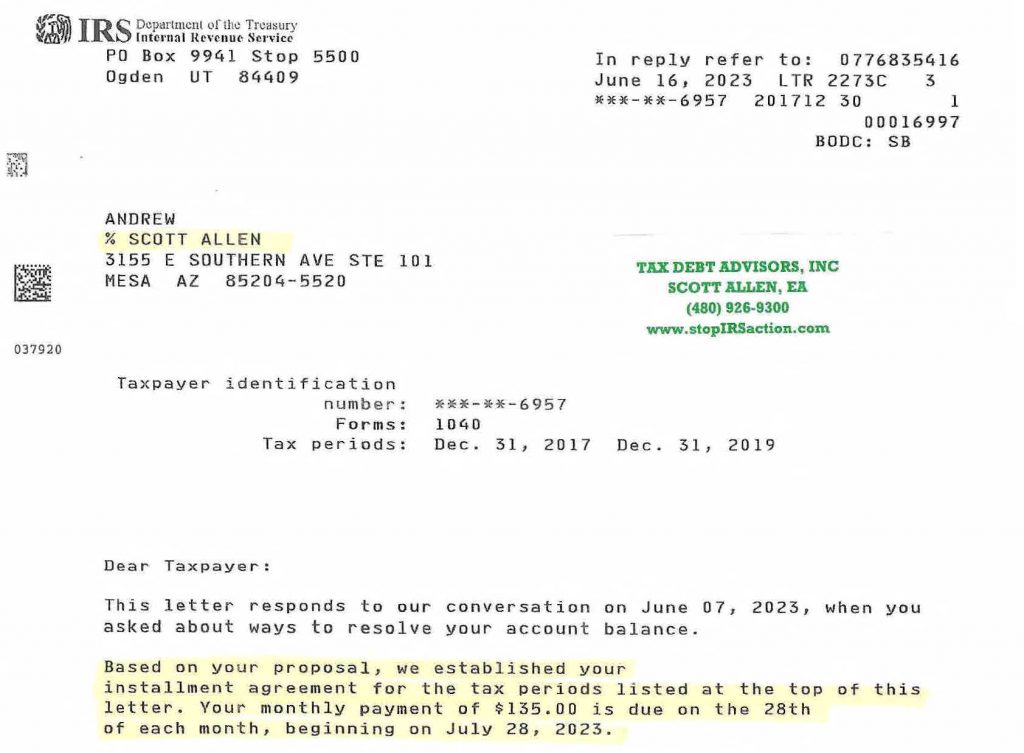

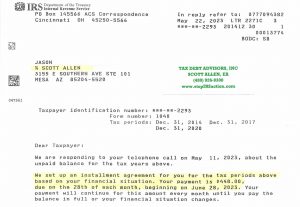

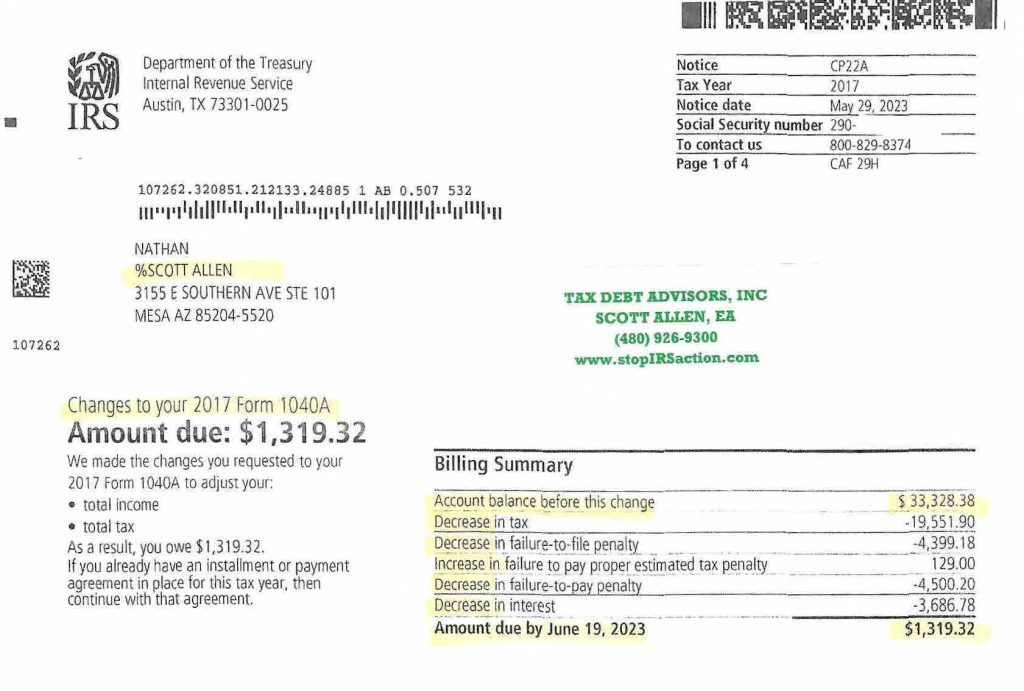

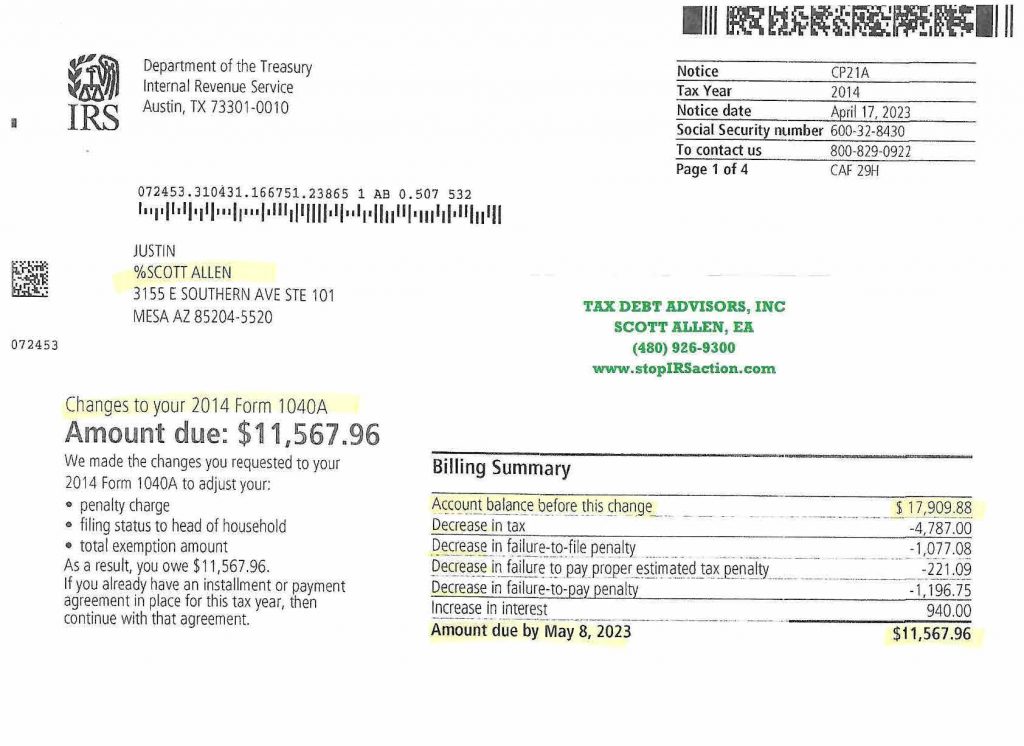

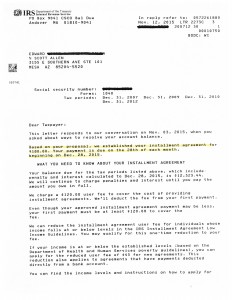

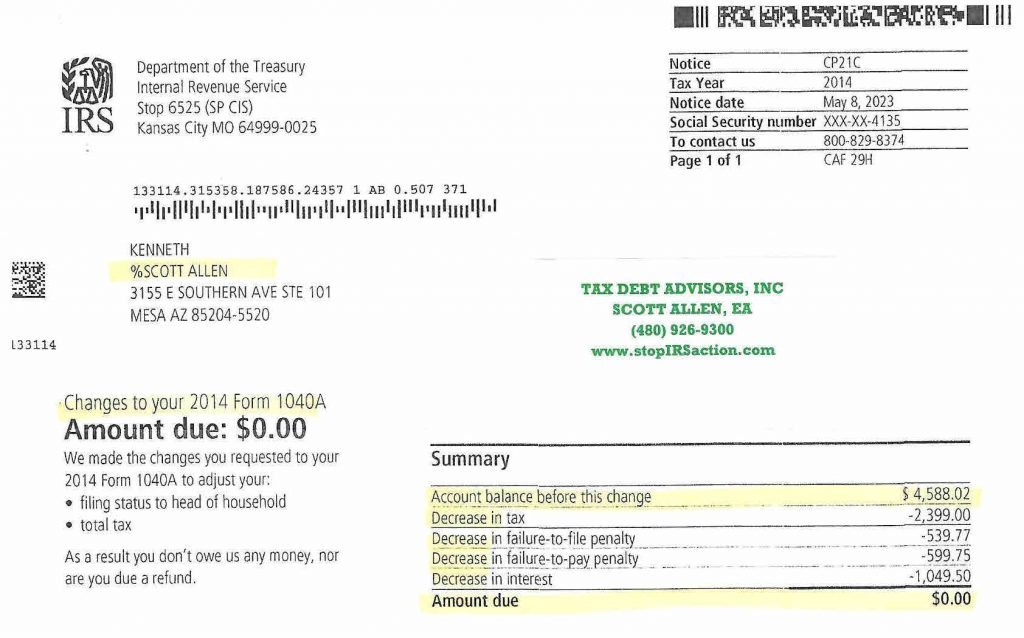

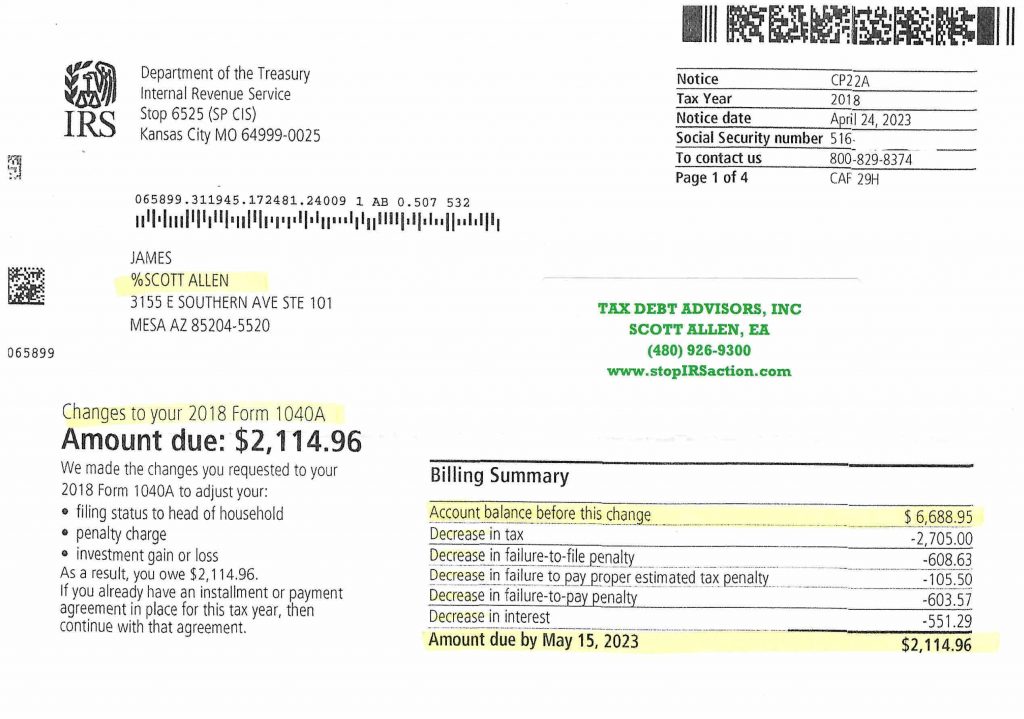

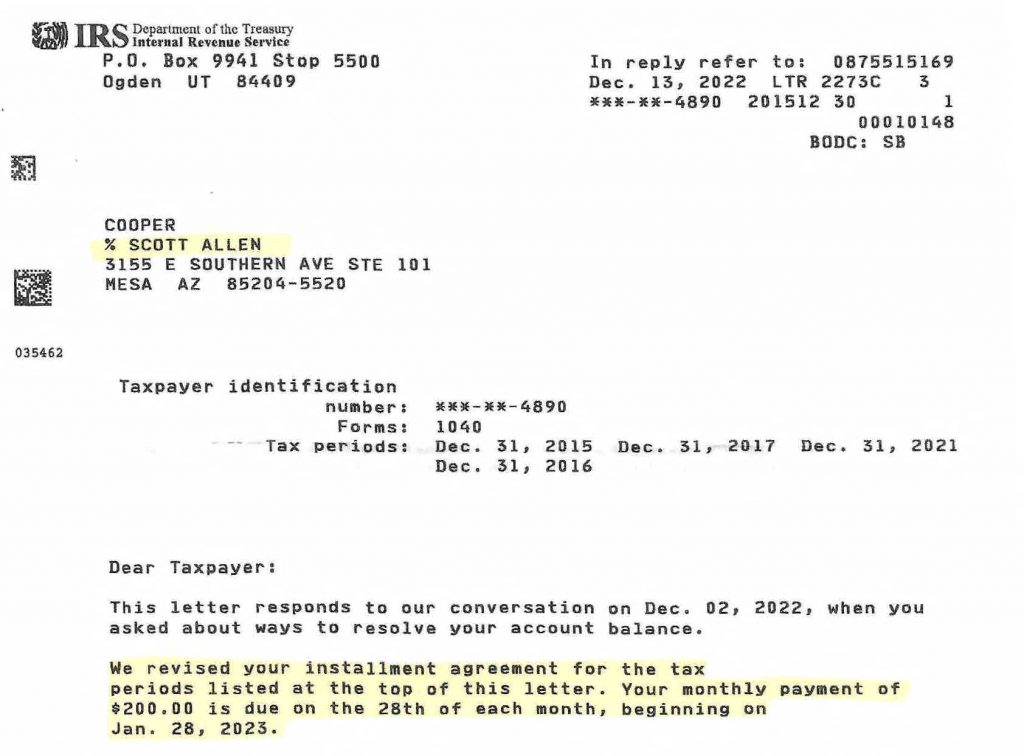

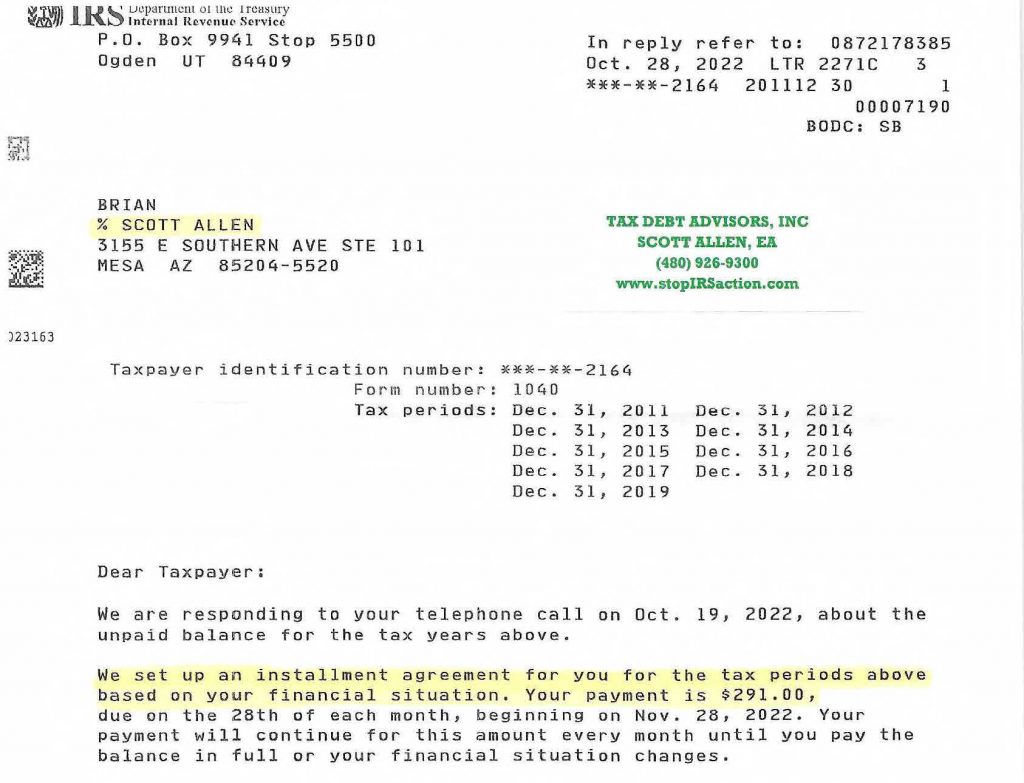

Obviously, the best solution will resolve your tax debt before an Arizona IRS tax lien is filed. Call me today for a free initial confidential consultation to see specifically what options apply to your situation. For Andrew, (a current client of Scott Allen EA) it was an aggressive payment plan negotiation that prevented the IRS from ever filing an Arizona IRS tax lien in the first place. By being proactive, Scott was able to get Andrew on a $135 per month payment plan and keep the IRS off his back and make sure the IRS does not slap a tax lien on him. View the IRS agreement letter below.

Scott Allen, E.A. – Tax Debt Advisors, Inc

Facts about Arizona IRS tax liens for Arizona Residents: IRS help from Scott Allen, E.A.

Mesa, Apache Junction, Avondale, Buckeye, Carefree, Cave Creek, Chandler, El Mirage, Fountain Hills, Gila Bend, Gilbert, Glendale, Goodyear, Komatke, Litchfield Park, Luke AFB, Paradise Valley, Peoria, Phoenix, Queen Creek, Scottsdale, Sun City, Sun Lakes, Surprise, Tempe, Tolleson, Waddell, Whitman, Wickenburg, Youngstown, Flagstaff, Tucson, Payson, Winslow, Sierra Vista, Page, Prescott, Globe, Yuma, AZ

Apache County, Cochise County, Coconino County, Gila County, Graham County, Greenlee County, La Paz County, Maricopa County, Mohave County, Navajo County, Pima County, Pinal County, Santa Cruz County, Yavapai County, Yuma County